A few tips on trading a level. It’s not rocket science and I’m not that clever.

Students often tell me finding a level is hard enough but knowing how to trade it is even more difficult. Therein lies the rub. But hopefully this little post will help you.

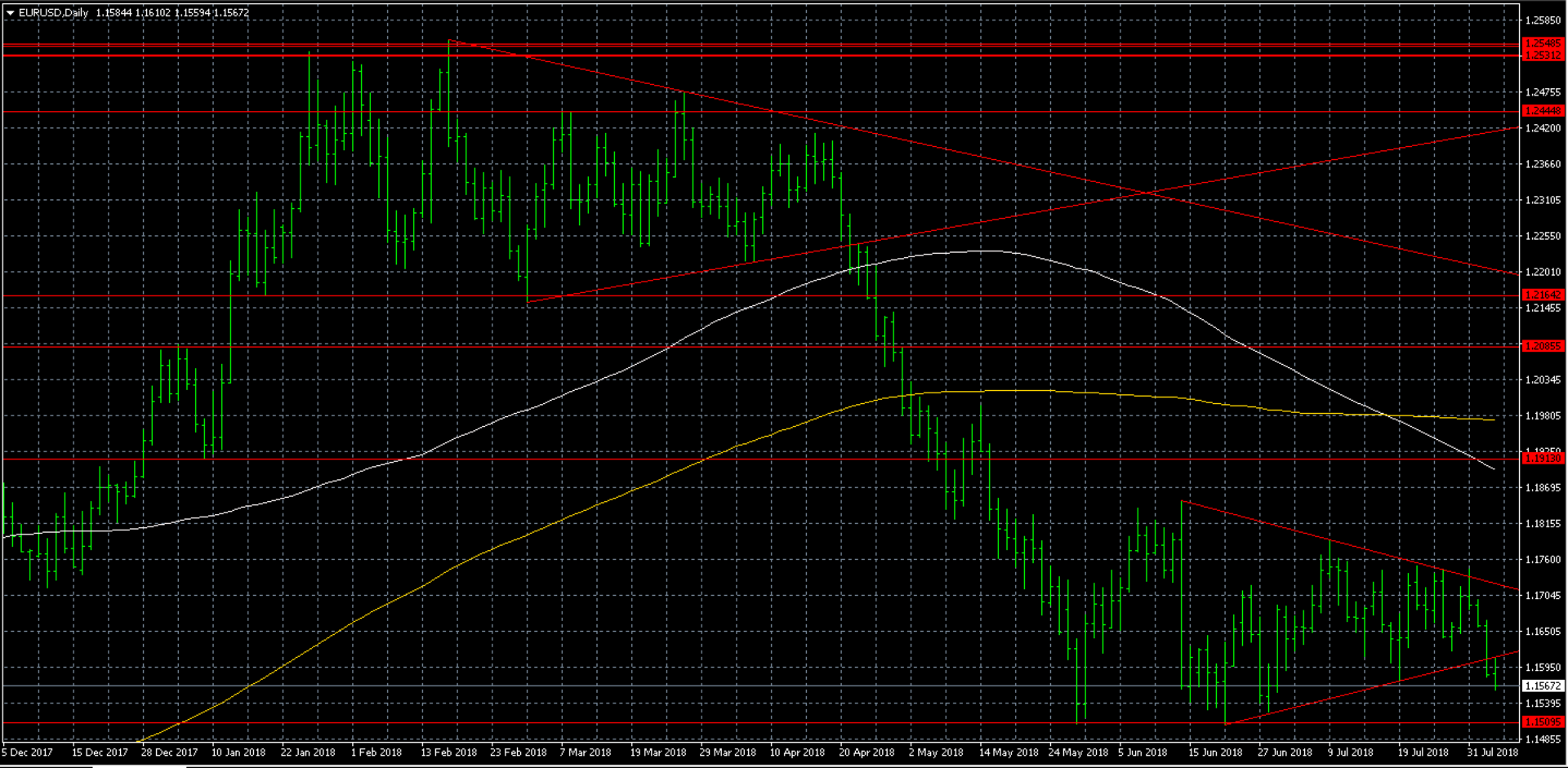

Look at the pennant below. The lower trend line broke around 1.16 big fig before nfp and I sold into it afterwards. Support became resistance. Easy peasy – lemon squeezy. Now look at 1.15 area. The levels i am watching are 1.1507/9 and 1.1526 which was close to a triple bottom – but not quite. So, where is the level and entry point ? Here are a few rules I have. You might like them too.

AP rule number 1 – be flexible. Would I put a single lumpy bid in at 1.1510 ? NO. I would layer it in at 1.1530 then more at 20’s then even more at 10’s stop at 80’s

AP rule number 2 – assess your risk. If you are layering 3 parts to a trade i prefer it to have the same risk as a single trade. If you’re trading 20 lots (2mil) then splitting it into 12, 6, and 2 should help. HOWEVER doing this split into a wide spread will increase your risk so be aware.

AP rule number 3 – question the value of the trade. Does EURUSD warrant a buy with a pristine US macro picture ? Yes but not 5mil worth If you want to know more about mentorship or our next masterclass get in touch.

- How to trade: A LEVEL - August 4, 2018

- USD mixed – a bit like me - June 5, 2018

- What is the market focused on ? Over to you trader. - May 29, 2018