GBPUSD continues to climb but the hard work is yet to be done

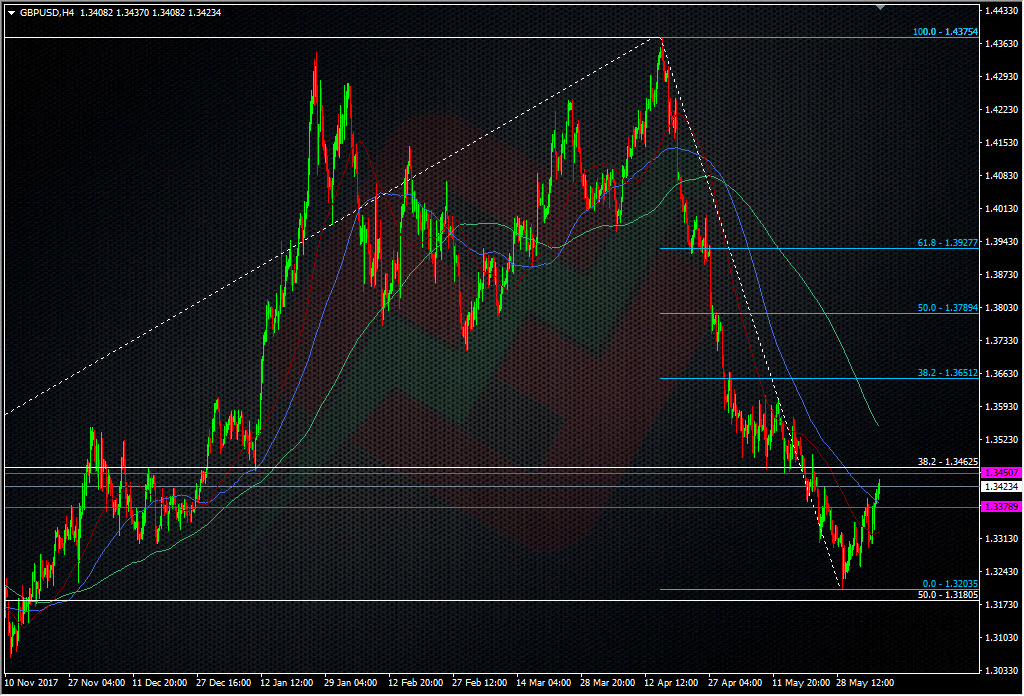

The pound seems to have decided on a direction at last and ‘up’ was the choice. The break of 1.34 now gives cable a shot at some old support levels around the mid to upper 1.34’s.

The 1.3450/60 area is where I’m seeing the next test for this bounce from the May lows, and it’s a sticky point all the way up through 1.3500 too. For me, the ultimate test of the downtrend will be the 38.2 fib of the April drop at 1.3651.

As I wrote on Friday, like the euro, GBPUSD is playing with two trends. It looks like the longer-term uptrend is trying to reassert itself but it still has a lot of work to do. This 1.3450-1.3650 area could be a good battlegorund for both trends. If we manage to hold above 1.3400 and then get above 1.3450, look for a run higher to test the upper levels. Failure to hold 1.3400, or a rejection of 1.3450 and we’re likely to fall back and possibly back under 1.3400.

For today, 1.3400/50 is the intraday range to watch but I’d give a failure to hold above 1.3400 a bit of room down to 1.3390 before thinking about this break being over. Under 1.3390 and we’ll look bearish again.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Keep them coming Ryan , interesting read, Thank You