Fixed Income Research & Macro Strategy (FIRMS)from Olivier Desbarres at 4X Global Research 13 July 2018

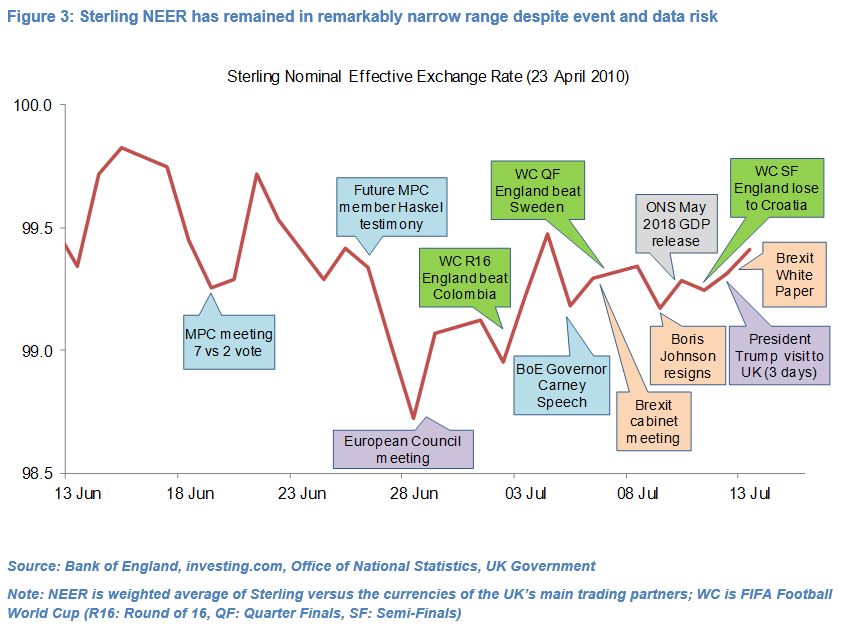

- UK financial markets have been remarkably stable in the past month despite having to contend with a plethora of macro data, UK-driven events and global developments.

- The FTSE 100 has traded in a narrow 3.4% band since mid-June, market pricing for a rate hike at the Bank of England’s policy meeting on 2nd August has oscillated between 15.5bp and 19bp and, in line with our expectations, Sterling has remained directionless (Sterling caught in growth and Brexit trap, 13 June 2018).

- The government’s detailed and much-awaited blueprint for the UK’s relationship with the EU post Brexit, published on 12th July, sets out a vision whereby the UK would remain aligned with the EU on many fronts in exchange for close trading ties.

- The receding risk of a Hard-Brexit and recent upturn in economic growth have seemingly put a floor under Sterling but with the domestic political and economic picture still very cloudy markets, which were wrong-footed ahead of the Bank of England meeting on 10th May, are rightly not getting carried away.

- Near-term the risk to Sterling is somewhat biased to the downside, in our view.

- The market is already pricing in a 75% probability of the Bank of England hiking rates on 2nd August. At the same time a lot of the “good” news regarding Brexit is now in the public domain and the government still faces a number of challenging hurdles in coming months.

- In any case Sterling volatility is likely to pick up as we get closer to the October-November deadline for the British and European parliaments to approve a post-Brexit deal.

- The “will of the people” and “a price worth paying” has become an unassailable government mantra not just despite evidence that the price has been and will continue to be high but because of tangible evidence that the price may not be worth paying.

- Prime Minister Theresa May has only a few months left to prove to the electorate, companies and markets that doctrine and reality can align.

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

What part of the article would suggest that Brexit is probably coming home??

I think it’s just a play on the England football song.