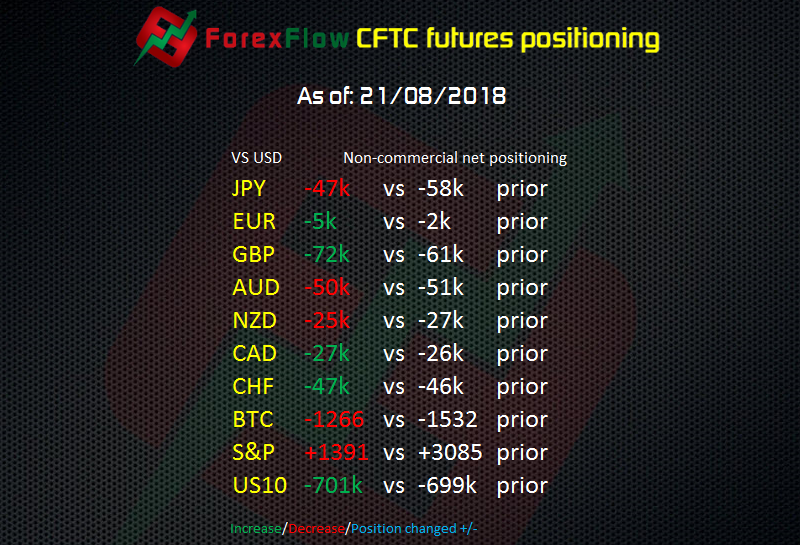

The Commitment of Traders net speculative positions report from the CFTC as of Tuesday 21 August 2018

- JPY -47k vs -58k prior

- EUR -5k vs -2k prior

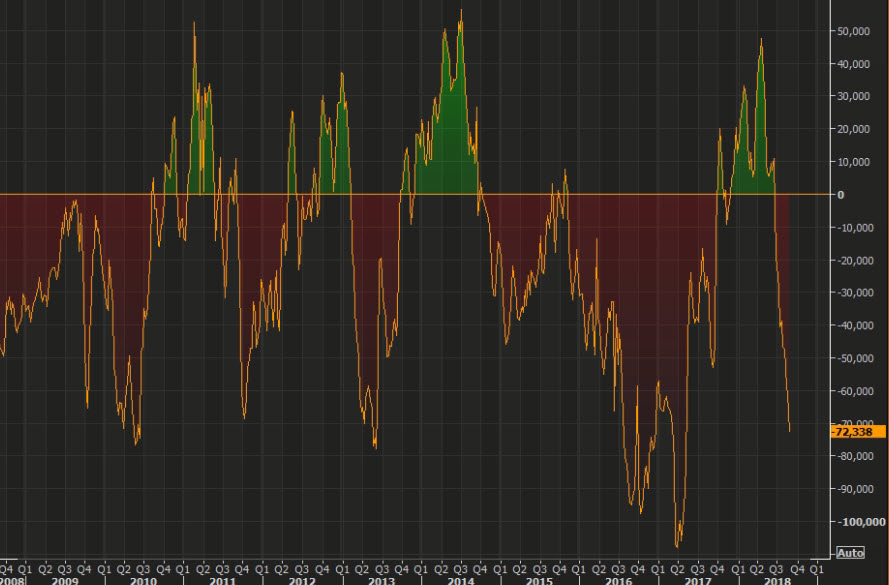

- GBP -72k vs -61k prior

- AUD -50k vs -51k prior

- NZD -25k vs -27k prior

- CAD -27k vs -26k prior

- CHF -47k vs -46k prior

- BTC -1266 vs -1532 prior

- S&P +1391 vs +3085 prior

- US10 -701k vs -699k prior

GBP shorts might be rueing this week after a jump of under 200 pips. They look set to challenge the size of shorts post-Brexit vote. Perhaps a sign of the market’s view of the Brexit progress and possible outcome so far. That’s one currency open to a huge squeeze if a (good) deal gets done.

Little change elsewhere, save for the JPY which saw shorts reduced. Still, the dollar is the currency that everyone want s to hold.

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Hi Ryan (and all). As I am always (way to) late for the GwtF thread.

Decided to follow up Sunday evening on last weeks analysis, with excellent results.

EU, EJ, GJ and (to a lesser degree) GU longs paid off handsomely without looking back, 795 very green points at 1% margin, and (finally) out of the scalping routine, I liked it.

Observing EU’s moves of yesterday and today, got me the feeling it was mostly dealer driven over the last 2 days, with probably a bunch of institutions getting filled and a wall of orders waiting in the 1640-60 area (both directions).

As for Yen, my regression channels correctly predicted a stall of the fall but the (crucial) 1150 level got rejected today (although CNY might have played a role in that)

As for the coming week, I think to stay sidelined come Sunday and Monday, checking out EU & UJ’s PA.

For the entire FXF team (and readers), have a good weekend.

ps: EUR/GBP short looks very promising for next week !

pps: Forgot to mention; the +795 net result for the week included also UJ long with entry at 0988 and exit at 1122.

Well traded AGP. Good to see those pips fly in.