US and Mexico relationship might be blooming but three might be a crowd for MXN

The potential switch into trilateral NAFTA talks might put a temporary end to my USDMXN shorts. The US and Mexico have been getting along fine but the whole NAFTA thing relies on Canada coming back to the party. Whether that happens as (seemingly) easily as with US/Mex is the question but based on the arguments that have gone on before, I very much doubt it’s going to be plain sailing (as the news today is proving).

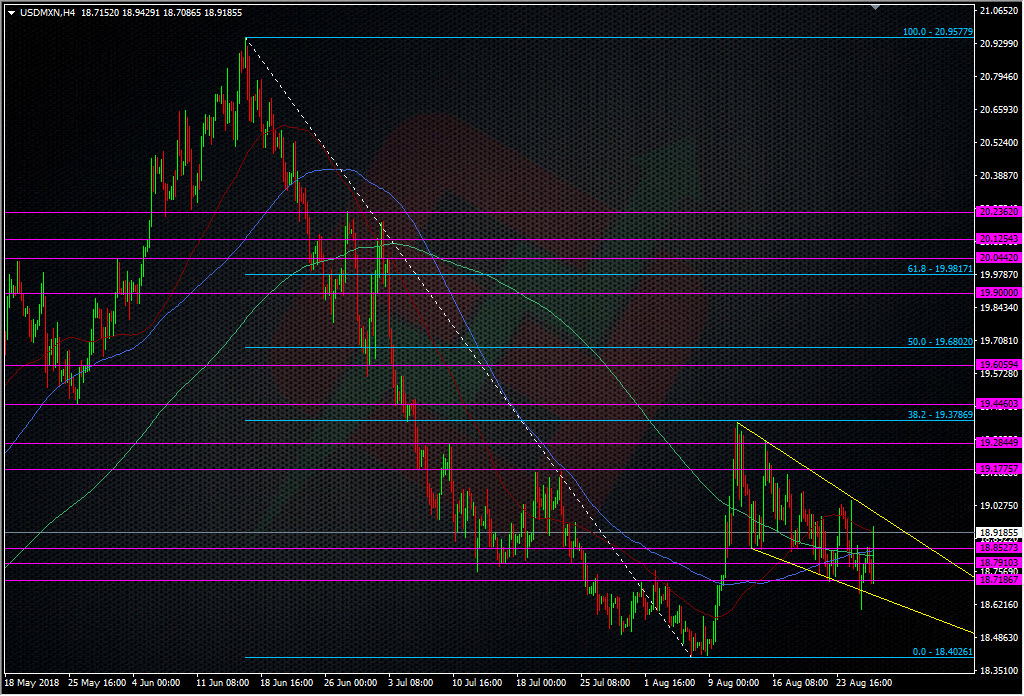

If Canada and the US start to get into loggerheads over negotiations again, that’s going to leave Mexico twiddling its thumbs, and that wil be a negative for MXN, and hopes of getting a full deal done. That could mean a push on 20’s again. We’re already seeing some of this reflected in the price, which is looking more like hitting 19.00 than the recent lows.

Technically, the downtrend is still in place and the 19.17/18 area looks key for direction. I’ll be watching this even closer now but I’m not too bothered if I have to knock the balance out on a break higher as I’ve banked on the dips anyway and it’s been a good run. If we do hit the 20’s again I’ll look to re-enter shorts again but will have to see what the news is driving it there, and it will be a fresh view and a re-evaluation of the strategy.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Just read this. Ok 19.17/18 is the area. I was a bit further up at 19.25. I think you could be right on this one and i might bite the bullet. Funny innit, Cad goes bid on the possibility of a deal and Mxn goes offered on the done deal in principle. Narked I didn’t take 60’s…