In the huge world of investing, different risks and returns suit different investors, yet they can all affect FX markets

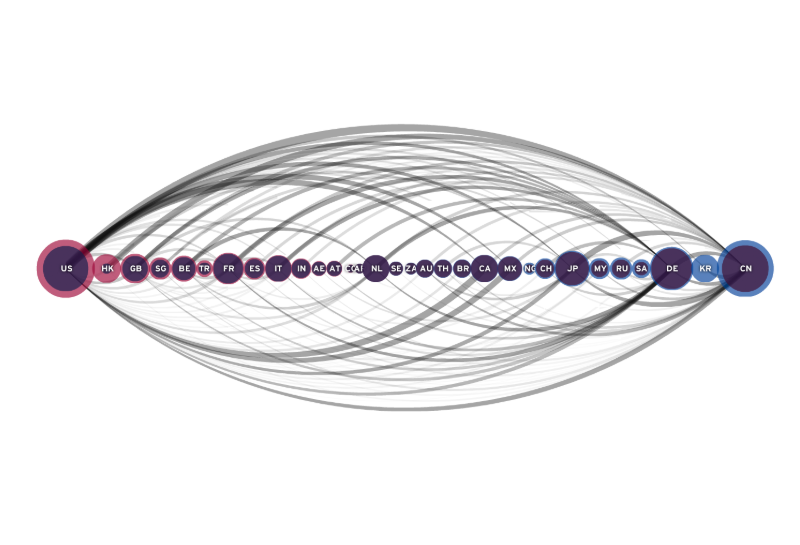

The financial world is pretty one big massive merry-go-round of investment flows. Firms are always looking for ways to increase investor returns and thus their profits. It’s the ebb and flow of these global moves that help move FX prices and give us trends or counter trends as money goes looking for those returns.

It’s a long-held belief here at ForexFlow that one of the big reasons why USD remains supported at the moment is because of the relative safety and returns available from the US due to its strong economic and rising interest rate environment. These returns may not be huge but they’re matched with lower risk, and that’s often good enough for risk averse investors.

But, what about those who seek bigger returns or greater risk? Bloomberg highlights what is basically the effect of rate divergence and how even pretty safe and low risk investments can offer better rewards. They highlight that there’s better returns for US investors selling out of Treasuries and into EU and Japanese bonds, even when yields are lower than the US, solely on the lucrative strategy of FX hedging.

They say that US investors can earn more than half a percentage point holding German 10yr bonds (currently 0.462%) than they can staying in US 10’s (3.154%), with returns increasing if investors look higher up the risk ladder (at the likes of Spain and Italy). The fact that this play is grabbing the attention of the big investment houses shows how big the opportunities are and therefore how it’s reflected in the FX moves and trends we see every day. In effect, it’s a carry play but with a bit more complexity. Carry trading is something that we’ve previously highlighted all traders should pay attention to.

So, what does it mean for FX markets and our trading?

Taking our thoughts on why the US is a destination for low risk returns for foreign investors vs a possible exit from US investors to other shores, it goes some way to explaining why we’ve not seen any huge range breaks in FX. With a few exceptions, EURUSD has spent months inside a 1.15-1.18 range and USDJPY has been pretty much stuck 108-114 for over a year. That suggests that these flows are pretty much offsetting each other, generally. Where we see the differences (and thus larger moves or temporary breaks in FX) is when one side becomes larger than the other, or other news or factors are at play.

Remember thought that this is but one big aspect of the reason money moves around this fair planet. While we get direct FX moves on things like fundamental and monetary policy changes, the flows then follow up by readjusting to those conditions, and so we get the moves we all trade. As the Bloomers article states, at some point the ECB/BOJ will start closing the gap on rates and then we’ll see the end of these divergence opportunities and the flows will start moving again, out of those and into something else. It’s those type of scenarios that can bring the big trend moves in currencies and the types I love to trade on a longer time frame. While we wait for big moves like that, we get everything else coming through the market that affects prices and causes

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022