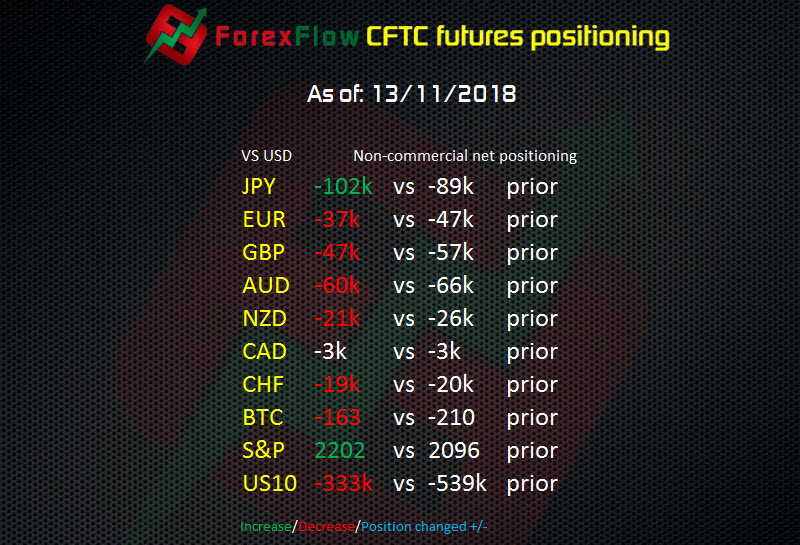

The Commitment of Traders net speculative positions report from the CFTC as of Tuesday 13 November 2018

- JPY -102k vs -89k prior

- EUR -37k vs -47k prior

- GBP -47k vs -57k prior

- AUD -60k vs -66k prior

- NZD -21k vs -26k prior

- CAD -3k vs -3k prior

- CHF -19k vs -20k prior

- BTC -163 vs -210 prior

- S&P 2202 vs 2096 prior

- US10 -333k vs -539k prior

USDJPY longs got a bit of a bloody nose this week. The 113.60-114.00 range was looking solid but the floor fell out of it yesterday and today. A big change in bond shorts too and that’s been reflected in the falling yield. If 10’s go back under 3% we could see some real fireworks both there and in USD. Is the market finally coming to the realisation that the Fed might actually slow hikes or be near the end of their cycle?

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

I realise the importance the COT report but i struggle to relate that information into a day trading strategy. Any suggestions as to how i can use this to improve my outlook?

Hi Patrick

The short answer is you can’t. For one thing, the data is lagging, for another the futures market is only a small piece of the trading picture. A lot of people try to tie a lot of analysis on the spot market with the futures market but most of the time they are chalk and cheese.

The way I use the COT data is more of an indicator of sentiment but even then it’s not great at that some times. I’ve seen positions growing for months despite the price going the other way. It can also give false indications because of the nature of it’s use for hedging.