Fixed Income Research & Macro Strategy (FIRMS) – 5 December 2018

- In the past three weeks, British and European Union (EU) negotiators have formally reached an agreement on a draft “Brexit deal”, in practise two separate albeit inter-linked documents: 1) The terms and conditions of the UK’s exit from the EU – the legally binding Withdrawal Agreement (WA) and 2) The non-legally binding “Political Declaration on the UK’s future relationship with the European Union” (PD).

- This was in line with “our core scenario that the UK and EU will reach a mutually-acceptable deal of some form in the next two months” (see Final Twist in Brexit Plot).

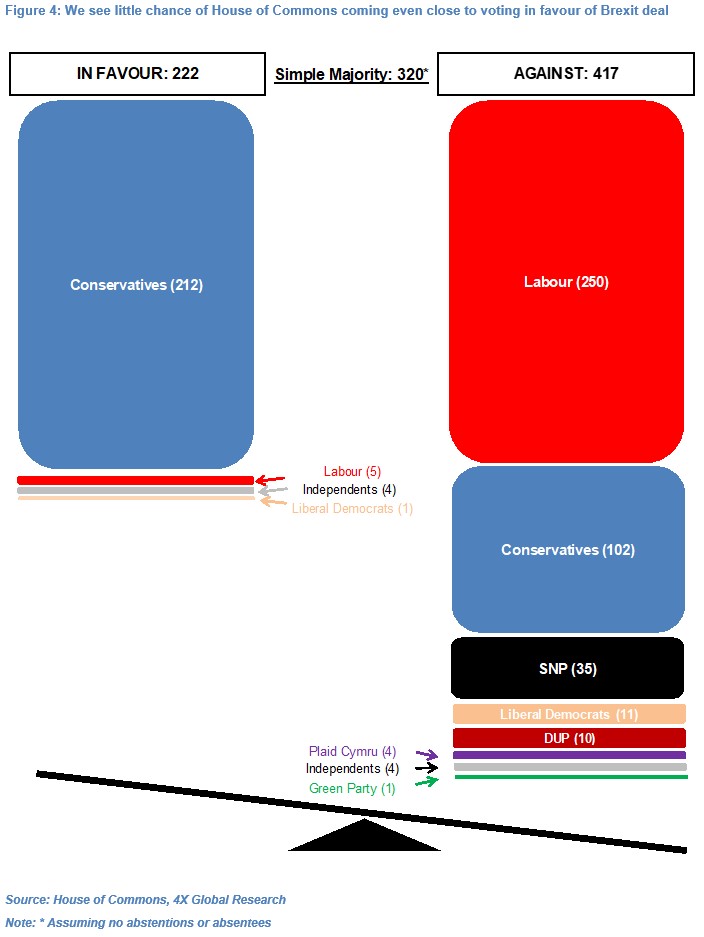

- On 11th December, the House of Commons will hold a “meaningful” vote on a motion on whether to approve the WA and PD. The 639 “voting” MPs (Members of Parliament) will hold one vote and a simple majority (320) is required (assuming no abstentions/absentees).

- Whether Prime Minister May can muster a majority of her Conservative MPs to vote in favour of this Brexit deal and whether opposition party MPs vote along party lines will likely colour the UK’s political, economic and financial landscape for months and years to come.

- We are sticking to our core scenario that the House of Commons will vote against the Brexit deal. Our party-by-party analysis, which takes into account among other factors individual MPs’ public statements and voting records, suggests that over 400 MPs, a significant majority, could vote down the government’s Brexit deal.

- If this proves broadly correct, we expect markets to re-focus on the risk of the UK leaving the EU without a deal and for an already under pressure Sterling to weaken further, with the size of the parliamentary majority (against the deal) likely to impact the magnitude of Sterling’s sell-off.

- In the event of a “no” vote, a number of possible routes would open up, including a second House of Commons vote, a vote on an amended bill, a new round of negotiations with the EU, the UK leaving the EU without a deal or a second referendum.

- Our core scenario is that Theresa May and the Conservative Party would put political survival ahead of ideology, swing with political and popular sentiment and hold a second referendum.

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022