It’s another ‘D-Day’ for Theresa May as she puts the Brexit deal to Parliament for approval. Here’s the safest ways to trade it.

We’ve had some key moments in the Brexit journey so far but this week looks set to be the biggest yet. Not only do we have UK Parliament voting on the deal (Tuesday) but also a ruling from the ECJ (Monday) on whether the UK can cancel Brexit, and a UK Supreme Court case on Thursday to decide whether an EU exit bill passed in Scottish parliament is was constitutional.

The Brexit vote is the biggest event on the list but the ECJ ruling could be just as important. The ECJ advocate general has already passed an “opinion” that Brexit can be unilaterally revoked by the UK and many are expecting the judges to rule that way too.

The pound this week is going to be very volatile, and more so than prior weeks and events.

As much as I’m going to put forward where I see the opportunities, I’m also going to strongly suggest that traders take the utmost care if they are looking to trade the pound this week.

Where do things stand on Brexit now?

Here’s where we are right now;

- Theresa May lost a vote on what happens to the Brexit deal if she loses the meaningful vote. That was a big deal as it potentially hands power back to Parliament on what happens next. It effectively handcuffs Theresa May.

- May is expected to lose the vote by a very large margin

- May supposedly has little room to go back to the EU to change the deal to suit the detractors

- The EU has said that they may allow only cosmetic changes to the deal

- The possibility of a no-deal, no-Brexit, a second referendum, a leadership challenge or a Government no-confidence vote has increased

- The Irish backstop is still the biggest fly in the ointment

- The DUP (the mob giving May her government majority have confirmed tonight (Sunday) that they won’t vote for the deal (not a surprise)

- The vote is expected to take place around 7pm GMT on Tuesday but it might drag on as it’s coming at the end of 5 days of debate.

One thing that has changed this last week or so is the comments on ”no-Brexit” at all. Even Theresa May has been saying it. Before, it was a deal or no-deal but this new inclusion seems to be appearing more regularly and that will play into the possibility of the UK revoking Brexit (see ECJ case), or offering a second referendum.

How has the pound been reacting recently and what can we expect?

The market has been in locked pretty tightly between 1.27 and 1.28 for the last week os so as the market has been counting down the clock to this week. A no-deal scenario is obviously still a big negative, while a deal, even in its current form would be seen as positive by the market initially, as it would go some way to ending the uncertainty. A no-Brexit in some form or another would also be seen as positive for the pound. As we also saw last week, May losing some control over ‘what happens next’ was taken as a positive by the market. The situation now is that anything that might stop Brexit or change it for a perceived better is going to be good for GBP. The only real negative is a no-deal. That pretty much makes it a positive/negative ratio of 2 to 1. Obviously, things aren’t as black and white as that but it gives us a bias to say that the possible biggest price risk this week is up not down.

And, that’s going to be the basis of how I look to trade GBP and Brexit this week.

GBP over the ECJ vote

If the vote matches the prior “opinion”, it effectively makes a strong case for remainers to push May to acknowledge it. It doesn’t mean it will be accepted in the UK but it will be an ace held up the sleeve. There’s some uncertainty over how the EU might act but it could be seen as another positive for the no-Brexit scenario, and thus GBP.

Update Mon 10th 08.05: ECJ rules UK can unilaterally revoke Brexit. GBPUSD popped around 40 pips before falling back and making a new session low.

GBP over the meaningful vote

The big one!

The market is pretty much expecting May to lose, so in the first instance of that happening I don’t really expect to see much downside in GBP. However, because we’ve got such high volatility, my low expectation for a downside move could still be a move of 200+ pips on the kneejerk reaction. What I don’t envisage is the pound suddenly trending lower for an indefinite period, and heading to somewhere like 1.20 or worse.

What will be key for the vote is not whether May loses but by how much. If she loses by a landslide (100+ votes), it will confirm the mountain May faces to change minds. We’ve heard from lots of people saying they won’t vote for the deal but what people say and what they do is another matter, especially in the case of politicians. It’s also a factor that the “lots” of people aren’t “all” the people and while some may not be making themselves heard, there might be plenty who will back the deal.

If the vote is closer (a loss by 20-50) votes, that gives May a bit of a lifeline to try and get them on board by offering concessions on the deal. That will, of course, require going back to the EU with those changes. On the face of it, a lot of the opponents of May’s deal could be swayed to vote for it if she went back to the EU last minute to try and change some aspects of the deal. Either way, that’s a less negative loss for May and so a smaller negative for the pound but it will also drag things out further as May will need time to go to Europe to push for any changes and it will risk kicking the can past the Dec summit, and bring a possible delay to Brexit closer.

If it’s even closer than 20, that would be seen as positive for the pound because May would have a chance of turning those 20 her way.

A shock result would be the vote passing and if that was to happen, we’ll have real fireworks. We could get a move akin to that of the 2016 Brexit vote itself. As much as it looks a long-shot, it’s not an impossibility, and as traders we have to be aware of that.

What we also need to be aware of is that this vote isn’t a ‘one and done’ situation. In fact, the longer this has gone on, the more this vote has become a litmus test for May to gauge the real sentiment. After this vote, changes to the deal can be agreed behind the scenes and amendments added to a fresh vote. This also takes some sting out of a possible negative reaction in the pound. We could find ourselves faced with several votes and the more that happen, the closer we’ll get to it passing.

There has also been some talk this weekend that the opposition Labour party might call for a vote of no confidence in the government if May loses but while that call might happen, it’s unlikely to pass.

So, as you can see, once again we have a lot of factors in the mix and a lot that can happen. The more ingredients we have in the pot, the harder it is to trade because none of this is a simple 2 factor situation, i.e. if ‘A’, do this, if ‘B’, do that.

Even trying to set this post out as clearly as possible has become a task because none of it is clear in reality.

How do we trade it?

The million dollar question. It’s apt that I throw in a warning once again. There will be traders looking at this and thinking that there’s a jackpot trade to be had. The problem is, when we face the possibility of big moves, we also face the possibility of being very wrong and losing a lot of money. In trading, unlike the different outcomes from this event, there are only two factors. Price goes up, or price goes down, and we only have two outcomes, we win or we lose. There is no need to take any increased risk just to try and catch a lottery win, so if you are in doubt, stay out, watch the show, and look for a trade when things are clearer. This isn’t an event to be pissing around with moving averages on a 15 minute chart.

For me personally, I’m going to position myself with as little risk as possible so here’s a couple of ways I’m looking to trade it.

Firstly, as I see the pound moving higher to a much greater degree on good news than it would fall on bad news, I’m looking at two fairly low risk trades. One way is less risky than the other but it may not be available to all traders.

The first way is to use buy stops way above the market. If the vote passes, we could well be talking about GBPUSD heading to 1.40. We would most definitely clear 1.30, so positioning a series of buy stops way above the current price would potentially catch a shock positive outcome. The risk with this type of strategy is that you get spiked in on something that looks good at first but doesn’t turn out so good when it’s dissected, or the trade gets triggered on news that then needs another outcome to help it proceed. I would usually use this type of strategy to reverse a trade against a break of a big level, or to catch a break of a big level in normal trading conditions.

The risk with this type of trade is defined by the stop placed when it’s triggered. Given the potential volatility in GBP, defining where to put a stop on such a trade is the difficult choice. One can either go with a smaller trade and wider stop, or a bigger trade and tighter stop. Both ways are risky given the volatility and the greater moves we might see.

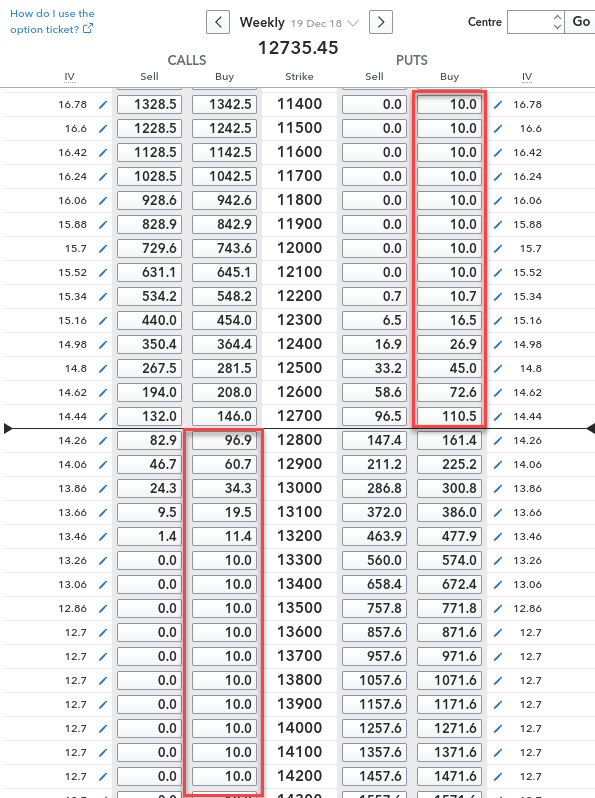

The second strategy is to look at options. The problem with options is that they are not readily available to most retail traders and they can be expensive to trade. However, there are certain CFD type products that allow traders to utilise an options type strategy. In the UK, there’s are a few brokers that offer option markets. For this example, I’m using the pricing from IG. Below is a shot of the GBPUSD option pricing for options expiring 19th Dec.

The way options work is that you pay a premium to take a position in the market at a certain price level (called strikes). Options that are “in the money” (ITM) cost more than those “out the money” (OTM). There are many facets to options trading but for this example, I’m talking about them purely for the reason of using them to position for any big moves in GBPUSD, and in this instance, going long OTM strikes.

Options work two ways. If you buy, your risk is the premium or price you pay for them. If they expire ITM you get back whatever the premium is on expiry +/- what you paid. If they expire OTM, the value is zero and you lose the premium or price you paid for them. Your maximum risk is the price you pay. If you sell options (which we’re not looking at here), your risk is potentially unlimited.

Looking at the prices below, it’s the OTM options I’d look at. That would be buying calls in strikes above the market (to catch a move up), or buying puts below the market to catch a move down. Simply, calls are the right to buy, puts are the right to sell. In this case, because this product is a CFD, we’re merely trading the premium price moving and not a physical option.

As you can see, the prices get cheaper, the further OTM they go.

As I feel that the greater price risk is up, I would look to buy calls from perhaps 1.29, 1.30 and/or higher. The prices are 60.7 pips at 1.29 and 34.3 pips for 1.30. Those prices would be my maximum risk on the trade. Those prices change as the underlying price does, so if the price moved up, so would the premium, meaning I would move into profit. If the price fell, so would the premium, and I’d be in the red. As you can see, the higher the strike price above 1.30, the lower the premium price is, so even 19.5, 11.4 or 10 pips for either the 1.31, 1.32 or 1.33 strikes would be a very low risk trade if the vote passed. There is merit in buying the downside puts too but I don’t feel there would be as much value.

To look at it another way, it’s a very good risk reward trade and because you know your maximum possible loss, there’s no need to fumble over where to put a stop loss. I also, don’t need the spot price to trade above my strike prices to make money, the spot price just has to rise further than it was when I entered the trade. For example, if I bought a 1.31 call for 19.5 pips, and the spot price rose to say 1.29, the premium (19.5) would have moved higher giving me a profit. I could choose to take profit or leave the trade running. However, I would lose money even if the premium was higher than my entry (but I chose not to close it) and I held it to expiry, and the spot price was below 1.31 at expiry.

FYI. I don’t want to complicate the matter further for the less experienced but options also have a timing factor. The premium prices decay the closer you get to the expiry. For example, if the price of cable didn’t change between now and 19th Dec, the premiums would still slowly drop, particularly the further out the strike prices were. For this event, that’s not really something to be concerned about because I’m only likely to trade these as a one off for a potentially big price moving event. It’s more a factor for those who trade options regularly.

One thing I won’t be doing is when trading this is increasing my trade size just because it’s a big event. I’m not going to be putting 30-50% of my account on this just because there might be a home-run trade. Traders need to be sensible and worry about not losing money, not on outlandish dreams of how much they might make. My biggest fear in trading is always being wrong so I always approach my trades with the right risk mentality and money management, so that there are next to no emotions in the trade. I will know and will have accepted my loss from the outset, and I can adjust things further if the market shows I need to.

This will be a very volatile week and for many “traders”, the temptation to try and make a killing on it just by “guessing” an outcome will be a lucky decision for some, and an account crushing one for others. There is no need to guess in trading. If you have a view, trade it with the appropriate risk and money management parameters. I do not want to hear of any horror stories after this has passed. If there’s anything more you’d like to know about trading Brexit, let us know in the comments. For live coverage of how traders will be looking to trade this week, join our live trading room on the ForexFlow platform.

Good luck and trade safe.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

excellent write-up, ryan. thanks. was thinking along those lines as well re the upside and buy stops. however, i would put the buy stops closer to market because if the algos go in full gear it’s gonna shoot fast and you’ll be able to capture at least 100 pips instead of less if your stops get triggered close to the high of the initial run up.

correct me if i am wrong, but the higher your entries are, means you’re betting on a 2nd wind continuation of the bull move over a longer time horizon. tbh, this requires a set of assumptions i am not able to validate ahead of time.

what an interesting situation. it takes me back to the EURCHF depeg when 3 days prior i was gonna go full tilt short and decided instead to stay long because of all i was reading online that the SNB had our backs.

let’s see… what does this button do? 😉

Hi Grassy, and thanks.

On anything like the vote passing we’ll go up big time, and yes, it will likely continue up, if everything is fine and dandy.

The problem with putting buy stops too close is that you risk being put into a trade on some minor positive news but nothing game changing. In that scenario, you’re at risk of a pullback.