Highlights of the December 2018 US Fed FOMC monetary policy meeting 19 December 2018

- Prior 2.00% – 2.25%

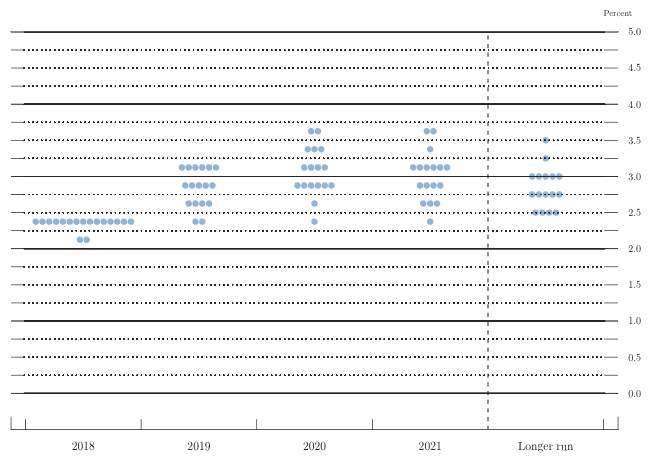

- REDUCES EXPECTED HIKES FOR 2019 TO TWO FROM THREE

- FED SAYS ECONOMY, LABOR MARKET REMAIN STRONG BUT EXPECTS GROWTH TO SLOW TO 2.3 PCT IN 2019 VS 3.0 PCT THIS YEAR, INFLATION WEAKER AT 1.9 PCT

- FED LOWERS ESTIMATE OF LONG-RUN FED FUNDS RATE TO 2.8 PCT FROM 3.1 PCT PREVIOUSLY, WITH RATES SEEN HALTING AT 3.1 PCT IN 2020 VS 3.4 PCT IN PREVIOUS PROJECTION

- FED CHANGES LANGUAGE SLIGHTLY, NOW SAYS EXPECTS ‘SOME’ FURTHER GRADUAL INCREASES IN FED FUNDS RATE WILL BE CONSISTENT WITH SUSTAINED ECONOMIC EXPANSION, STRONG JOBS MARKET AND INFLATION OBJECTIVE

- FED SAYS INFLATION NEAR TARGET WITH EXPECTATIONS LITTLE CHANGED

- FED SAYS RISKS TO THE ECONOMY APPEAR “ROUGHLY BALANCED,” ADDS IT WILL CONTINUE TO MONITOR GLOBAL ECONOMIC AND FINANCIAL CONDITIONS FOR THEIR EFFECT ON ECONOMIC OUTLOOK

- FED SETS INTEREST RATE ON EXCESS RESERVES AT 2.40 PERCENT, WIDENING THE SPREAD TO 10 BASIS POINTS BELOW TOP OF FED FUNDS TARGET RATE

- FED VOTE IN FAVOUR OF POLICY WAS UNANIMOUS

Not as neutral or dovish as some might have been looking for but nothing earth shattering in moves so far. USDJPY up 25 pips to 112.45, GBPUSD down 40 to 1.2618. EURUSD down just under 50 to 1.1382.

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022