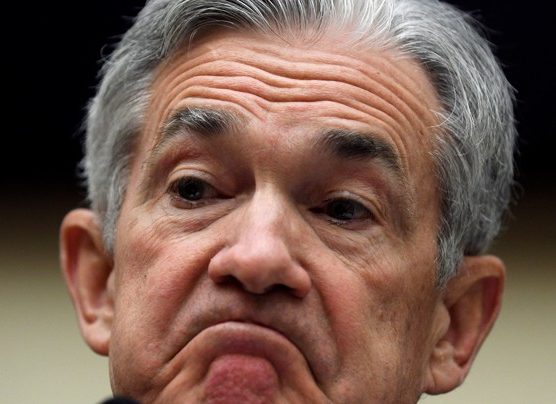

Fed chairs joint interview at AEA on 04.01.2019

Tomorrow from 15:15 gmt we’re expecting Powell, Yellen and Bernanke to participate in a joint interview about monetary policy, central banking and supply of money and credit at the American Economic Association.

In the light of the last non-dovish rate hike, the equity and bond markets moves and of course Apple’s revenues warning sparking last night’s FX crash( yes it was illiquid, yes it was Mrs Watanabe getting stopped on her carry trades but the move was there and real), the market is now screaming about the global slowdown. A lot has changed in one month’s time. Even though the US raw data are not pointing dramatically down yet, the incessant beating of the expectations has stopped and the housing market slows. Add the rest of world’s economic numbers turning negative, the calls for the Fed to pause are certainly justified, would it only be to calm the nerves.

Until the week before Xmas, the FX markets were pretty calm, the $ was hovering around in ranges versus the majors and EM markets were relatively quietly waiting for the new rounds of trade talks to kick off next week with the US delegation visiting China, digesting the equity markets correction relatively well. But the yearend flows and inability for stocks and rates to stand up through the festive period have changed the plot quite dramatically, crowned by yesterday’s psycho move, proving once more we can’t lower our guard at any time.

All of this heightens the importance of tomorrow’s get together a good few notches. Powell will have to be very careful tomorrow not to send the markets in yet another tail spin ahead of the weekend by coming over to hawkish and shrugging off the latest developments as “temporary”. He will need to give something to these markets.

Call a pause in the hikes, call for a pause in the balance sheet reduction or both. Facing two doves in the persons of Yellen and Bernanke could actually help him sending some easy lines he could bounce off. He could also use Apple’s warning to show the Fed cares about the big US companies. But he’d better use one these cards. After all, he already put the Fed in data dependency territory and said external events commanded caution at his latest FOMC presser.

What he will come up with will dictate the pre-weekend markets globally: FX, equities, rates, credit and possibly even oil and commodities by correlation with the growth outlook. Algo’s and the market in general will dissect every word he says. It’s pretty binary.

2 possibilities: he gives or he keeps.

-In the event he would ignore everything and is tired of his job we will be in for another armageddon session. I don’t know how much more pain needs to or can be taken in the major risk pairs but a revisit of yesterday’s lows in USDJPY and XJPY won’t be too far a reach imo. EM would suffer, equities take another dive and gold fly. The volatility will explode as the market will need to consecutively digest this meeting and prepare for next week’s US-China trade talks.

-In the preferred case he gives what the market wants, at least partially, risk will get a lift, equities will bounce, interest rates slide or stay roughly where they are as the market already priced out most of 2019 hikes. The (relative) high yielders and commod currencies should benefit : AUD, NZD, CAD and the EM’s we follow such as MXN and ZAR. Risk pairs, XJPY and XCHF should go up, gold lose some its shine and for the majors such as EUR and GBP, they may get a temporary lift as benefiting from a pause in US rate hikes but all in all remain inside the broader range , resp 1.12-1.15 and 1.25-1.28 due to their own problems.

In this scenario we could see a more pronounced risk bounce as there should be some anticipation US-China trade talks are in both interests to show some progress. USDJPY could regain the 109 or close to 110 even level but mainly crosses vs JPY should see a significant rebound if this scenario gets confirmed.

Volatility will initially rise on the event but should gradually come off as the markets will have got what it hoped for.

We’ll be back with some more precise levels to watch ahead of the meeting as the markets move quite a lot. Sticking them on 24hrs in advance is a bit useless.

- #Canada #Employment report preview. - November 5, 2021

- Rotation, ROTATION! - November 24, 2020

- $CNH living on hopium? Big week for the Yuan this. - January 13, 2020