Canada labour report 08.03.2019

TGIF!

The employment data have been strong over the past 5 months, consistently beating expectations with the exception of January. At the same time we saw a positive rotation between full and part-time jobs.

Today the employment change is expected to be flat with a smalls lower participation rate and a stable unemployment rate. It wouldn’t surprise to see a setback after such a strong few months but we can’t bet on it like a series of red or blacks at the roulette table. We have seen funnier series in the past.

Rather than the volatile headline number, unless a monster beat or miss, I like to focus on the ratio between full- and part-time jobs and after that the participation rate to gauge the real strength of the number. No different today.

Trading it?

The Canadian dollar has been hammered this week on weaker data, stress with China, locally for Trudeau and a forced weaker BOC.

Add to that oil prices coming off from their highs, today’s announcement Norway’s oil fund is getting cautious on oiler stocks.

No currency would be unaffected by such a cocktail.

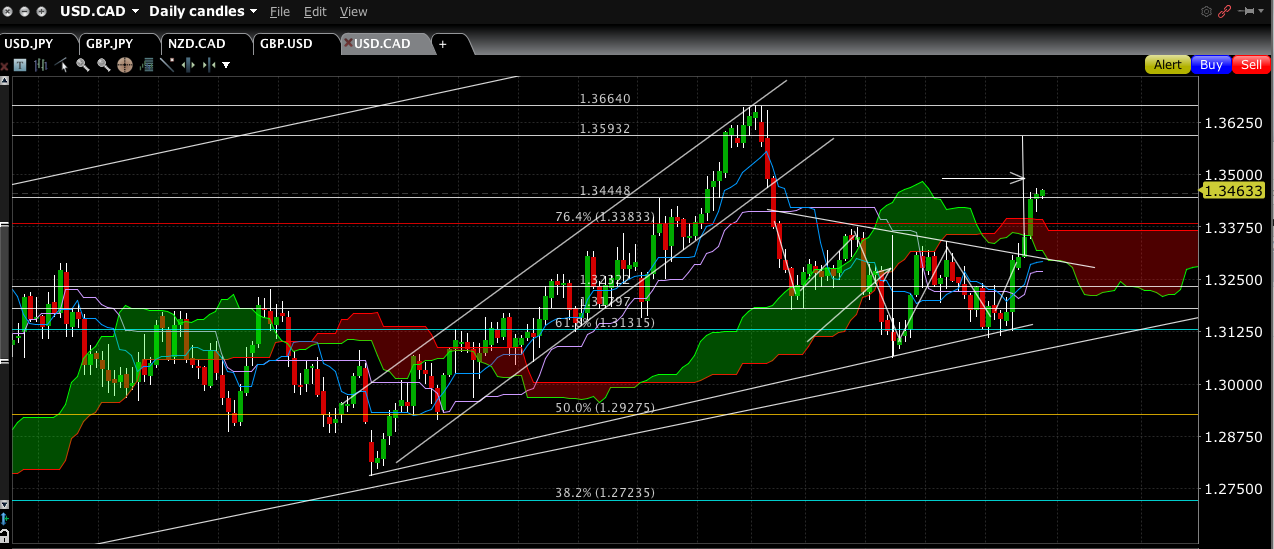

We ‘re trading at the lows of the week vs USD(1.3460) and the Loonie fell from his pedestal through the crosses. Today could be the coup de grâce if we’d get more negative numbers. As per below chart below there are some simple levels to watch.

To the downside in case of a positive surprise and a negative US labour report ,the first one to take into account is the past session’s low 1.3413, below there we have the top of the daily cloud and the fib call it 1.3380/90 and if all of that gives way, there is the bigger 1.3300 broken H&S formation, which if worse comes to worse( or best for the CAD) I reckon will hold in current context.

If in turn we get another whammy, there’s not a lot to hold USDCAD from racing to the measured H&S target at 1.3590 or even trade back towards the Dec 31st high 1.3665 where I’m thinking this rally could be enough for now.Beyond there we have to look back to 2017 levels closer to 1.38 but that would be a stretch imo.

Readers will know I’m long USDCAD from last week at 1.3222. I did take a healthy 200p profit on 2/3 of the position yesterday as I wanted to bank some profit this week and also leave room in the book to manoeuvre. If the report isn’t shocking I will look to add a bit on a low 1.34 print or a break through 1.35 to reach the target zones. The stop will be hidden under the Fib/cloud around 1.3370, where my simple stop profit on the 1/3 left over is currently placed in case there wouldn’t be a trade to have.

Besides this first plan, I will try to buy the 1.3300 break line, which coincides with the bottom of the Ichimoku.

Always be careful out there, the CAD trades like an EM currency when data are out. Control the amounts and emotions!

Stay safe and happy hunting.

- #Canada #Employment report preview. - November 5, 2021

- Rotation, ROTATION! - November 24, 2020

- $CNH living on hopium? Big week for the Yuan this. - January 13, 2020