Fixed Income Research & Macro Strategy (FIRMS) – 12 September 2019

- Not a day passes without the media and US President Trump pointing the finger at “currency wars” and “competitive devaluations”.

- The thrust of the argument is that central banks across the world, in a “race to the bottom”, are cutting policy rates and in the case of the ECB resuming QE, in order to weaken their currencies and boost export competitiveness and in turn economic growth and inflation. A concern is that these rate cuts are at best pointless and at worst damaging by fuelling the fall in global government bond yields into negative territory.

- We have a somewhat more benign interpretation, namely that:

- The majority central banks have cut their policy rates to boost borrowing, domestic demand and investment, rather than to weaken their currencies per se, in response to slowing domestic and global GDP growth and inflation and to the threat of a further global economic growth slowdown posed by the US-China trade war. If the end-goal of lower policy rates is indeed weaker (and more competitive) currencies, as often reported, central banks have other and arguably more effective tools, at least in the short-run, such as FX intervention.

- Ultimately, bar the People’s Bank of China (PBoC), very few central banks have actively engaged in a “currency war”; and

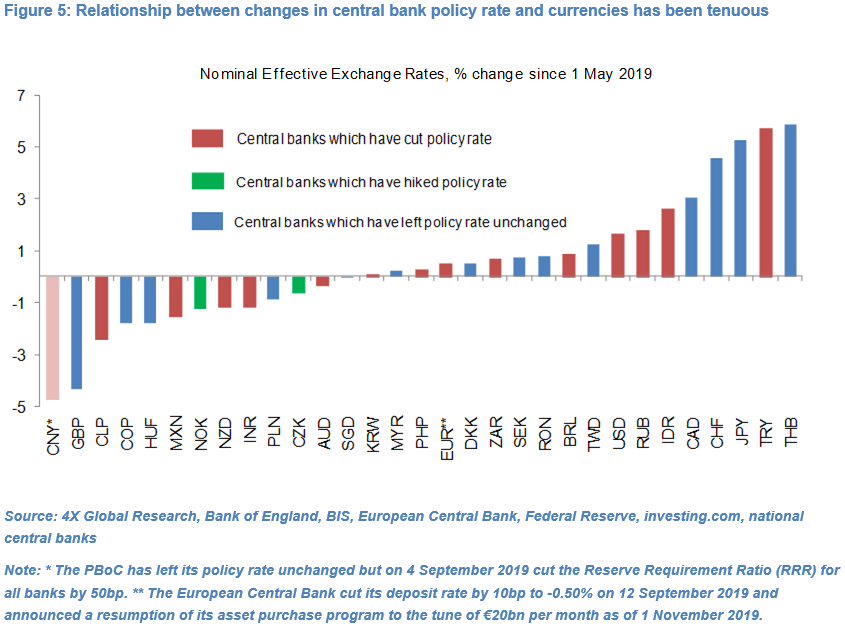

- There has been limited correlation between countries’ central bank policy rates and the performance of their currencies since the beginning of the easing cycle in early May, suggesting that at the very least “currency wars” have not been very effective (see Figure 5). The inverse correlation between the US-German government bond yield spread and EUR/USD spot exchange rate in the past year is a case in hand.

- Central banks may of course welcome a weaker currency as a by-product of a lower (relative) policy rate but the transmission mechanism to currencies and ultimately domestic GDP growth is not particularly compelling.

For the full research note, a free 30-day trial is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022