When markets are stuck in tight ranges, we must always be planning for the breaks

For many weeks we’ve seen pairs stuck in boring tight ranges, unclear direction and an unwillingness to push the boundaries but this week has been different. We’ve seen many breaks of short-term ranges and even some longer-term ranges, and trading these breaks has been very profitable this week.

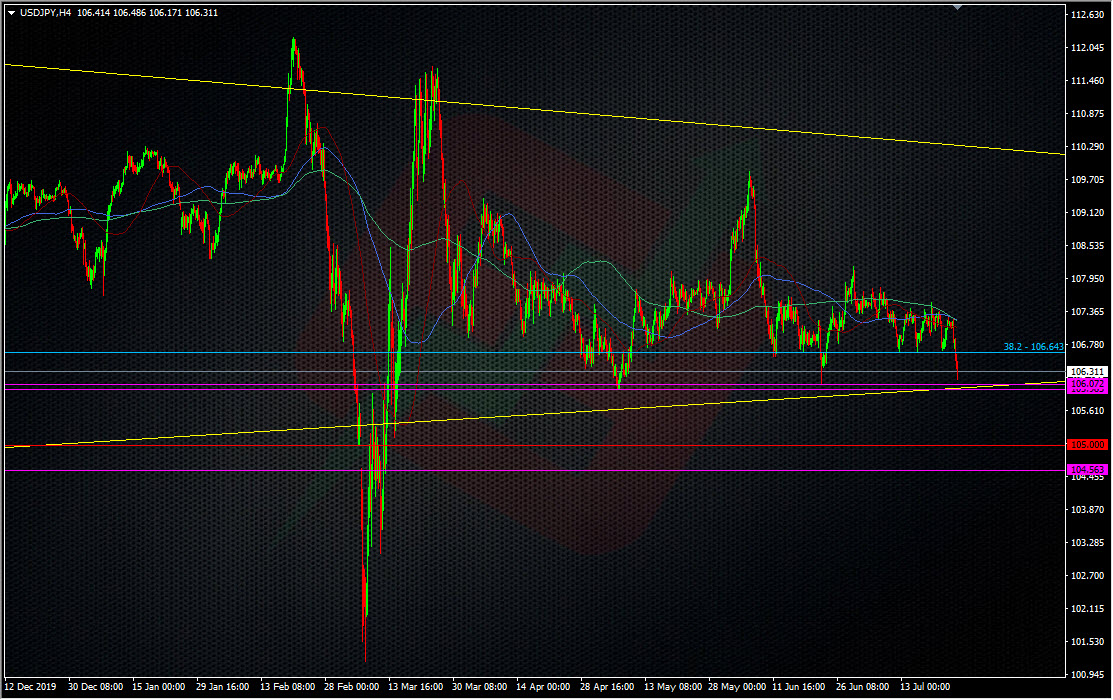

One such pair is USDJPY, which for the last few weeks has been stuck between 107 & 108, with even tighter mini-ranges trading in bewteen. I’d highlighted this price action in a couple of prior videos.

There’s been a particular downside level we’ve been very watchful of and it broke today.

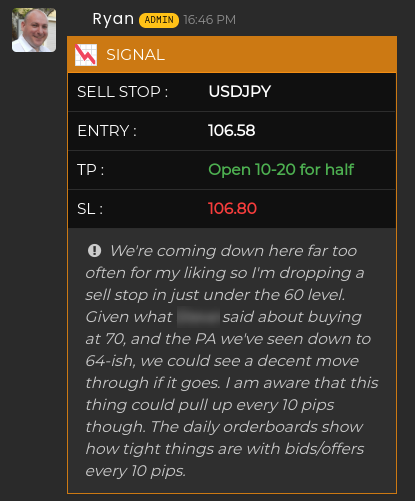

The key price action here was a continued move to test that 106.60/65 area. I never like a price coming to test a level too often and yesterday the warning bell was ringing loudly. When that happens to big levels, we need to plan how to trade it, and so that’s what was done late yesterday.

This morning, USDJPY traded down to 106.17. I’m now looking at taking more profit into the band of strong looking resistance 105.95/106.05/10.

This week we’ve had good break trades in several pairs, and that’s a sign that things might be changing in markets. When that happens we need to change too. If we’re moving from ranging to trending, we don’t want to be stuck with the “range trading” mindset that may have suited us so well for weeks. But, we also need to be careful that we don’t try to blindly try and trade trends that may not really exist yet. As always, price action is key. In the current environment, a couple of negative headlines and we could find ourselves back in the old ranges.

Break trading is all about following some simple rules. Pick your levels, look for confirmation, keep it tight if you;re wrong. In the case of USDJPY, I’ve taken some profit at 106.40 and 106.22 on my break short. Now, I’m watching the broken 106.60 level to see if it gets tested and holds. A quick move back above would potentially signal a quick fake out, while a hold would keep the break alive. From there I can plan how far to push the trade and at what levels I would look to cut more of the trade, and also how to trail my stops behind.

So, this week has been a good week for break trading, and learning how to do that safely and effectively is what all traders should do. As always, it requires paitience and discipline. My trade, and the analysis of the levels has been something we’ve all been doing in the ForexFlow trading room for quite sometime. This wasn’t an off-the-cuff trade, it came from learning the levels and seeing how they developed. It was about planning from an early stage. I’ve not been alone in either this USDJPY trade or many of the others done this week. The ForexFlow community has been on them too because they all put in the hard work to analyse the charts and all the other pieces of information we know about the market.

If you’d like a more detailed explanation on break trading, here’s a post worth looking at: Here’s how to identify possible breaks and then how to trade them.

And as always, if you’d like to join our community of traders so that you can see exactly how all the above trades and analysis happens in real time, each and every day, come and join us here.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022