Buying EUR could be one of the trades of 2022

I’m getting the ‘itch’ I get when I want to start building a position, and this one if for a long in EUR. With central banks around the world getting their hiking boots on there’s going to be plenty of expectations and divergences to trade, and these are the trades I love the most.

Since late 2020 I’ve been sitting on long USDJPY and short EURGBP positions, primarily on the both the Fed and BOE having to turn more hawkish over inflation. The USDJPY trade was mostly on the fact that the Fed was likely to be blindsided on their view that inflation (back then) was going to continue to not exist, while the EURGBP trade was to catch the end of Brexit, which I said throughout would always end with an agreement (the merits of that final agreement are for a different discussion 😉), and then to run into the BOE turning hawkish in a similar manner to the Fed but also that they would (if needed) move earlier than the ECB. That’s the very brief summary of it.

Those trades served me very well through 2021, and still are into 2022 as USDJPY hits new multi-year highs, and EURGBP hits new near 2 year lows but as the basis for those (and most of my longer-term trades) are on market expectations for those central banks, when it comes to them actually meeting those expectations (i.e hiking), that’s when I consider myself close to the end of those trades. As we’re at this point it’s time to assess those trades and look for fresh ones, and that’s where a long EUR strategy begins.

The basis for long EUR this year is very much on the laggard ECB playing catch-up. They are in the same boat as the other majors, regarding inflation but are still suffering from the virus fallout through this winter period. With the market getting set for maybe six Fed hikes over the next 2 years, and expectations for the ECB remaining very low, the risk is that those expectations start changing. This will cause the rate divergence to narrow between the Fed (and others) and the ECB. As always though, the hard part for this trade will be the timing.

Although the market is coming around to the fact the Fed is getting on a hawkish path, it’s still not fully onboard in the near-term, and to some extent, is already mildly pricing the end of a possible hike cycle further out (see the yield curve move for the latter part of 2023 and into 2024 into the end of last year). Right here at the start of the year, it’s looking like we might finally be seeing the full pricing of hikes over this year as US yields rise, matched with USDJPY (JPY crosses) rising too. But, there’s still plenty of work to be done on that front. It is only the first couple of days into the New Year, which can often be a bit funky, and there’s still plenty of levels that need to be broken before I start to think we’ve got a real move. One of those levels is 1.70/1.80% in US 10 year yields. So, for now, there’s a possibility that yields and thus USD have more upside to come, which is obvously means a further widening of policy divergence between the Fed and ECB, and thus a negative for EURUSD, which is currently looking very glum sub 1.13 (as I write this).

As far as the timing goes for building a long position, I believe that there may be more downside coming for EUR both vs USD and GBP as we fully price a more hawkish stance for the Fed and BOE. Quite possibly, I think that window is maybe another 2-3 months, based on how the data, virus etc evolves. While we know the rough path for the Fed, I have a feeling the BOE may be a bit more ‘panicky’ over inflation, which may cause them to get a bit more hawkish than the market expects. Time and data will tell.

Every trading strategy starts with the idea but then is built around the charts, and that’s what I’ll look at next for this one. At the moment, I think I’m going to focus on EURGBP and EURUSD for this trade.

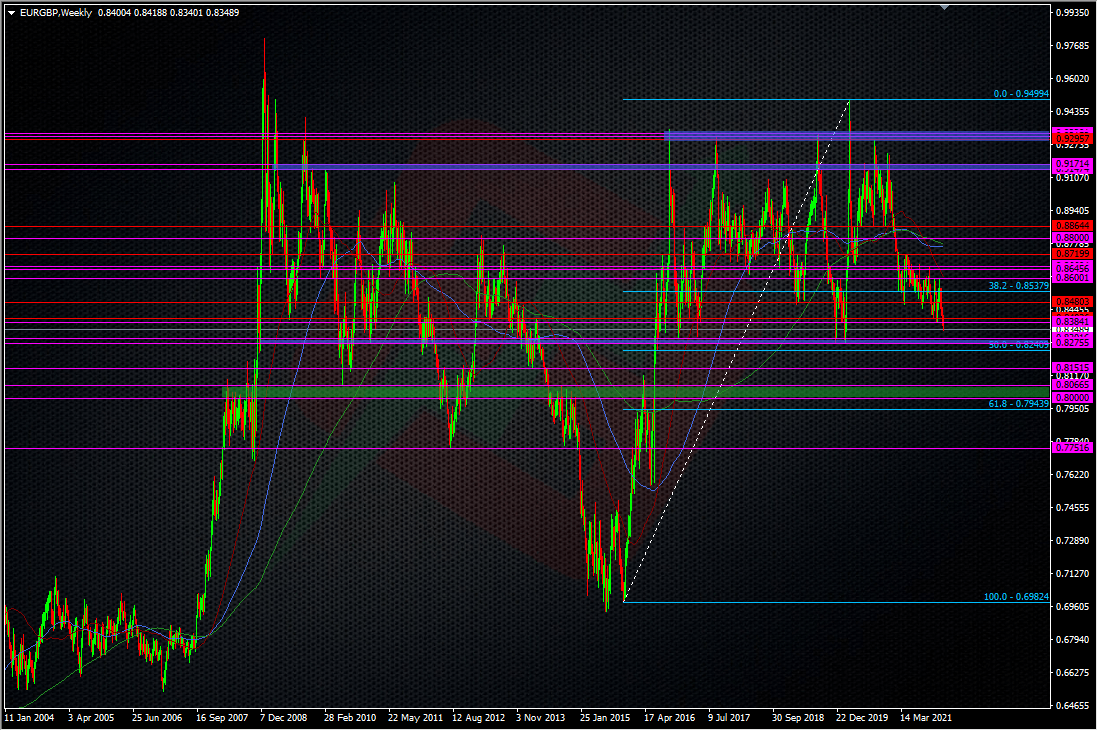

For EURGBP, one of my targets for the short trade was down around the 2019/202 double bottom at 0.8275-0.8300. Now, I use the term “target” loosely as when I trade I don’t pick targets I expect to get hit, they are merely places where the trend or directional move is likely to run into trouble or where questions get asked. On the way down, 0.8500/0.8480 was one of those and thus became a place where I took off some of my short when it struggled there. So, it’s an area that could hold strong support and one I’m looking to cut more of my short position at anyway but depending on the timing of such a move, it could also be the point I exit entirely and start to build longs. Right now, it’s my next major ‘place of interest”, and as we’re only 40 odd pips away as I type this, it’s in the frame more for a cut of the short, than a place to start turning long. How the level plays out over the near future will determine what I do. If it holds for a length of time (say it ranges 0.83-0.84/85 for the next couple of months), I’ll be more inclined to bail the short and look for longs.

If we break through that zone, then we have a bit of room to move down to the mid-0.81’s or more. If I had to put my finger on a number today of where I’d look to start building longs, it would be down in the mid-low 0.80’s, as highlighted above. If all went to plan and I got into longs, I’d be looking for a move back up top at least the 0.90’s, and maybe to one or both of the highlighted zones above there. If we went under 0.80, I’d be using the 0.7750 level as a place of assessment.

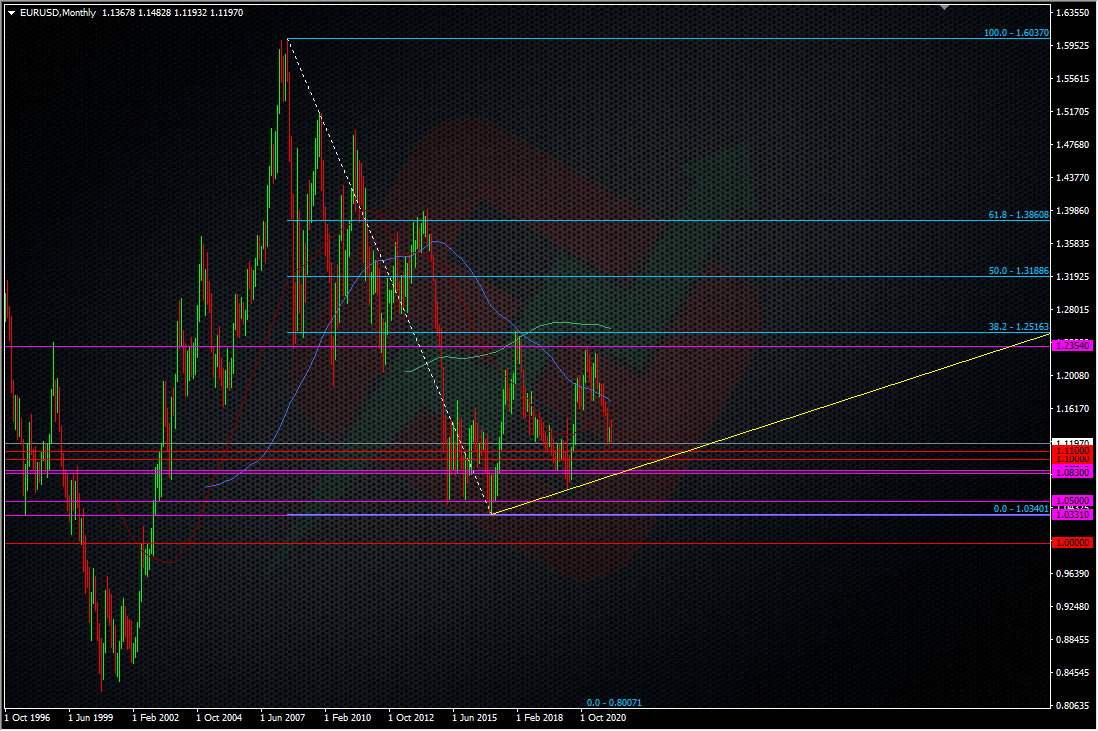

For EURUSD my potential ‘Buy zone’ would start from around 1.0900 down to 1.0450. I’d be concerned if we broke below there and so I would make the 1.0340 low a big assessment point if we go there.

One of my biggest issues when I trade longer-term is dealing with the FOMO. When I get a plan together, I can start getting an itch to jump straight in but for once, I feel very comfortable waiting this one out to see if we get that shove lower. I should point out that this plan is at its very early stages and there’s going to be a lot of boxes that need to be ticked before I start pulling the trigger. It may not even happen. Even if it plays out but I don’t get my levels, I can just look to trade the breaks higher. There’s always different ways to skin the cat.

What I’ll be watching is the data and how the central bank expecations are forming or changing, and that will be my main guide regarding timing. The levels may also be decided by that. I’m never rigid in these types of trades, as they can change or evolve over time. I’ll also focus a lot on where I may be wrong in the trade. That will actually get more attention and analysis than what could go right with the trade. With any trade, my first job is to always plan for the worst outcome because if I plan for that, I know my risk, I won’t be surprised by anything and the rest will take care of itself.

If the time comes to pull the trigger, I’ll be scaling in, not lumping it all on one level. I’ll have my entry levels and the places I’ll assess if things are going against me. I’ll have a rough idea of my stop levels but they will also evolve as the trade does. Come what may, if I haven’t got a decisive stop level, I’ll have a temporary ‘disaster’ stop in place to cover myself.

The main fundamental risks to the plan is if things change drastically. The virus could explode with a worse mutation, economies may not bounce back as strongly as expected and central banks may not be as hawkish as market expectations but even then, EUR may be a buy more on the fact of the Fed having to turn away from its hawkish path more than the ECB becoming more dovish. But, that would be a different trade to what I’m looking at so would need its own analysis and planning.

For once, I don’t seem to be alone with my thoughts for EUR, as I can usually be with these longer-term trade plans. There’s several members of the Forex Analytix community who have their eye on EUR longs too. Stelios for one is already dipping his toe in. I look forward to having a bit more company with this trade than I do usually.

Anyway, there’s the plan, albeit at the embryonic stage and I’ll be keeping it updated in our chatroom. If you’d like to keep up to date with it and with the other trades in our room (I have an AUD trade simmering on the RBA too), you can join us here.

Best wishes for 2022 and I hope you smash it out of the park with whatever trades you do.

Update: 27 January 2022.

So, we’ve just had the Jan FOMC and Powell has been far more hawkish than last time and EURUSD has been hit.

Now we’re messing around down here around 1.12 I’m starting to plot my levels in more details for my long EURUSD play. 1.11-1.10 start to get a consideration now, and I’ll be happy to look to play those both on the s/t & l/t. Under there is an old friend of mine around the 1.08’s. This is one of those old remembered areas that has shown up time and time again.

This was one of the major points for me when I was trading a similar long play back in late 2016, and on reading back over that post, what I’m writing now seems a bit like deja vu. But, that’s the power of l/t levels and why I pay so much interest to them over time.

But I digress, as much as I remember old historical levels, there’s never a guarantee that they show up or affect the price again. Despite the similarities, this is not 2016/2017 and the fundamental picture and drivers are different this time around.

However, history repeating itself is on my mind. Back then the ECB failed to build themselves back mon pol margin like the Fed did, and like the Fed are looking to do now. If history repeats itself (and the signs are already there), then that could mean EURUSD could be in real trouble. I think the risk of that is greater this time around than last time, and so I’m going to reflect that in my risk management. Like my AUDUSD longs, I’m going to go a bit smaller on my trades than I would normally. That will allow me greater freedom to spread my trades out and I can always add on any moves back up. It may be I try building into 1.11 & 1.10 but don’t like the PA so I can choose to treat them just as short term trades (i.e tight-ish stops) and if the price breaks down, I’ll start my l/t build lower down. The good thing with trading long-term is that I don’t have to make a decision right this second. I can pick my levels then judge the reasons why the price might be at them, and make my decision then.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022