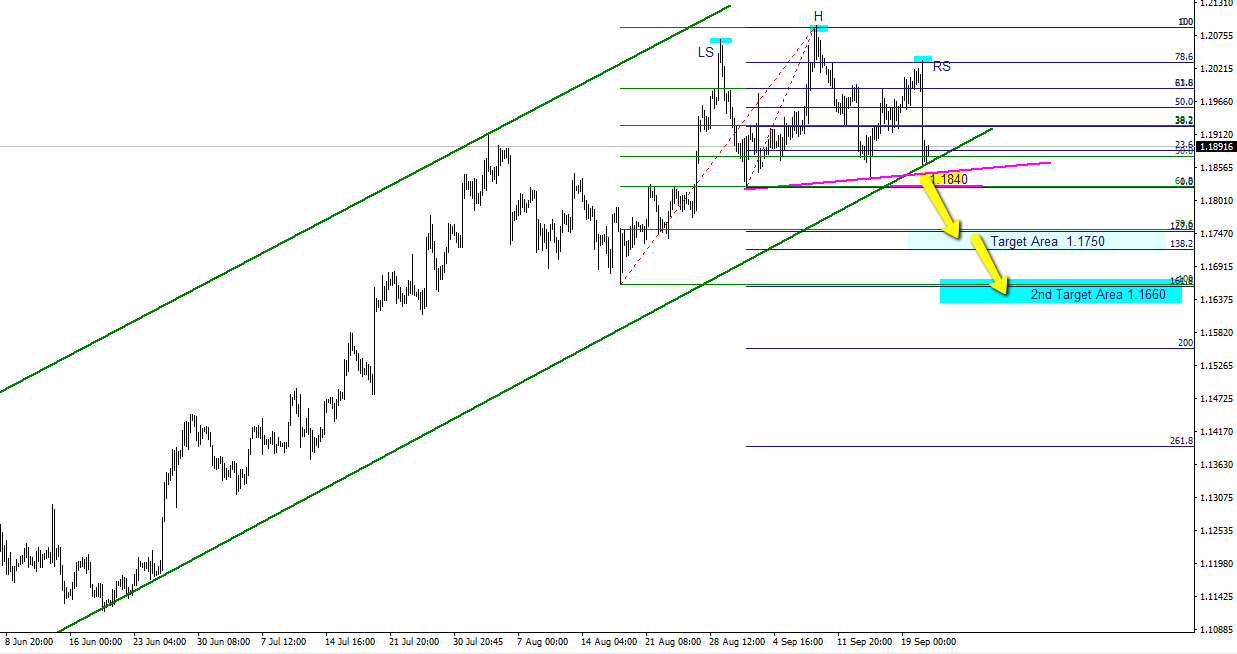

A possible Head and Shoulder ABCD pattern is visible on the EURUSD H4 chart.

The Federal Open Market Committee signaled this week (via dot plot) their willingness to keep the momentum with regard to Fed funds. Making a rate rise more likely at the Fed’s final meeting this year in Mid-December. USD bears were caught off guard and the dollar rallied. EURUSD and USDJPY should be the most obvious choices from a charting perspective, IF the USD were to be ‘front run’ ( bid ) leading up to the decision. CFTC Commitment of traders data from last week showed hesitation going into the present weeks trading, with EUR longs down 10K to 86K The previous weeks count was the highest long positioning since May 2011 at 96K .

My strategy here would be to sell a break around the 1.1840 level gunning for 1.1750. Charts are constantly evolving, so if hit, i will take some profits off the table and hope for a continuation of trend down towards 1.1660 .I will also be watching for a spike up from here towards the ‘RS’ right shoulder level around the 1.2030 area. This could prove to be an even better (slightly cavalier) short entry.

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019

Good post sir.