It’s time to crunch the numbers ahead of the US jobs report

First the numbers expected/prior;

- NFP expected at 90k Rtrs (Hi 209k, Lo -45k, Avg 89k ), 80k BBG (Hi 153k, Lo -45k, Avg 81k)

- Unemployment rate 4.4% unch

- Average hourly earnings 0.3% Rtrs, 0.2% BBG vs 0.1% prior m/m

- 2.5% unch y/y

- Average hours 34.4 unch

- Participation rate 62.9% prior

- U6 underemployment 8.6% prior

- Private payrolls 83k Rtrs, 74k BBG vs 165k prior

- Manufacturing payrolls 10k vs 36k prior

- Goverment payrolls vs 9k prior

Data into the jobs report;

- ISM Manufacturing employment 60.3 vs 59.9 prior

- ISM non-manufacturing employment 56.8 vs 56.2 prior

- Markit services PMI emp 53.4 vs 54.6 prior. Composite 54.8 vs 56.0 prior

- Markit manufacturing PMI emp 54.3 vs 53.1 prior

- Initial jobless Sep 284k, 259k, 272k

- ADP 135k vs 125k exp. Prior 228k

What do the top 5 NFP pickers say?

Goldies have slipped into the top 5 pickers and are going for 50k today.

- Jim O’Sullivan – High Frequency

- Stephan Buu – CTI

- Ryan Sweet – Moody’s

- Ray Stone – SMRA

- Goldman Sachs

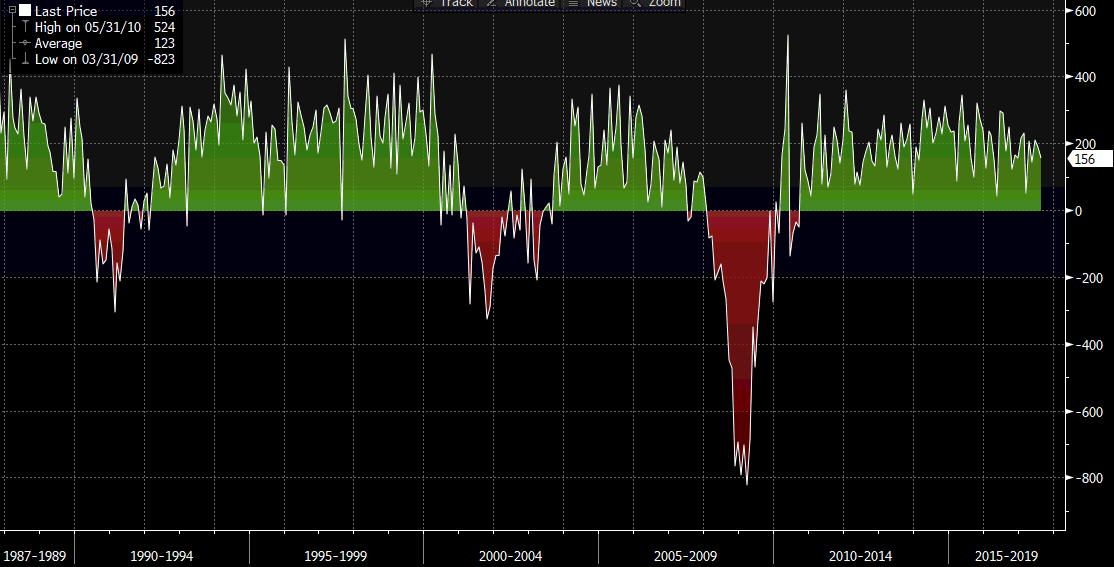

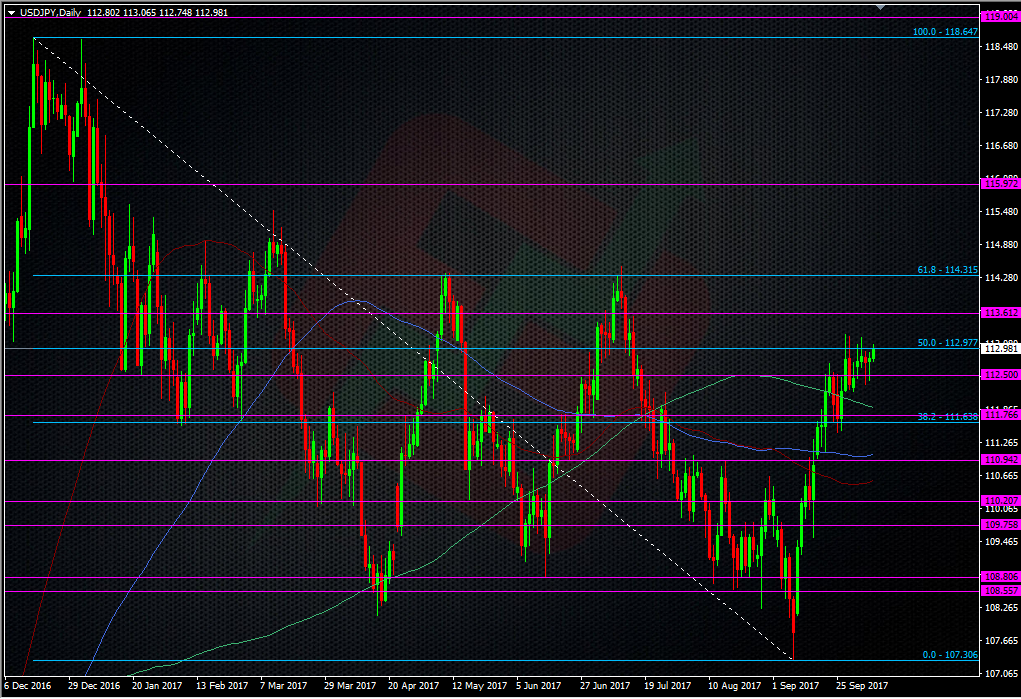

Recent NFP impact in USDJPY.

Twinned with a price chart, the impact monitor is a great tool as you can get an idea of whether we’re going to see a break out, or if we’re going to stay in a range.

What’s the trade?

Bar few exceptions, the world and his mate are set for a dissapointing headline, so if we get one, it’s not going to be a shock, and even if it is much worse than expected, it’s going to be brushed under the carpet pretty quickly. Remember too that the NFP number is a lottery at the best of times.

If everyone is looking for bad news, the bigger price move risk is if we get good news. Anything around or over expectations will be met with dolalr buying but the key is still the wages number. The big question is if the wages are bad, how much will be blamed on the whether. That’s a big unknown for me but history has shown that even the worst data can be excused by bad weather.

My gut feeling is that the dollar is certainly in one of its bullish moods, particularly against the euro and pound, and they haven’t dropped so far because of a possible one-off dodgy NFP. That overall strength is bigger than this one report. Therefore I think that any bad news dips in the dollar are going to be hoovered up and good news will be icing on the cake for bulls.

To repeat the levels to look at from earlier, for bad numbers I’m looking towards support at 112.40, 112.00/20 and 111.75/80. On good numbers, 113.60 is minor resistance and probably won’t stand up to much. 114.00 will be considered due to natural big figure resistance but the big level will be up at the May/Jul double top highs 114.30/50.

Good luck if you’re trading it but it’s also worth reading these wise words from my colleague Patrick on trading big data points.

Also, don’t forget, there’s still time to enter our first ever NFP competition for a great prize. Enter Here.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022