Some guidlines for trading the UK budget statement

First things first. If you haven’t already, please check out the excellent preview on the budget from my colleague Si. It’s a great guide for what to look out for overal.

What I want to do here is set out some thoughts about how GBP might trade over it.

It’s worth noting that this isn’t really an event like a data point where there’s a set expectation and either a miss or a beat will move the pound. It’s all UK based and has no real direct link to BOE monetary policy or anything like that, so trading it can be quite tough. As this is going to involve a lot of bluster from Chancellor Hammond, it’s going to go over the heads of most traders not proficient with UK fiscal matters. That said, a lot of it is going to over the heads of many who are too (me included) 😉 With that in mind and in an effeort to help traders cut through the noise, I’ll try and highlight the key elements that may move the pound.

The bulk of the news won’t be directly impactful on the GBP but rather the impact on the pound will come via the moves from investors long UK assets, and their view of the UK pre & post budget. For example. Any changes to things like stamp duty rising or further conditions applied to foreign owners of UK property could mean those investors sell up, or new investors are put off. That’s potentially GBP negative as it will be construed that money will flow out of the UK. Factors like debt and borrowing levels will affect Gilt rates and again, the flows possible in and out of the UK as investors see whether gilts become more or less risky. A further boost of Hammonds plans for more housing is another aspect to look at as more measures to support his initiative, to make it easier to build more homes, will boost the contruction industry and thus boost stocks, again that encourages foreign contruction companies to invest more in the UK, a GBP positive.

Corporate taxes is another big one to watch. If Hammond sticks with his plan to lower corp taxes to 19% next year and 17% in 2020, that will be welcomed by businesses and thus could be impactful for firms who might be thinking of leaving the UK due to Brexit. It may also encourage new business into the UK who want to take advantage of lower taxes. Once again, that’s a positive signal for the quid.

Trading wise, gauging how the pound may move is really all about the possible flow impact to the UK, and thus the flows in GBP. There may be some kneejerk moves but I’m not expecting anything huge unless there really is big news. The Chancellor is likely going to use this budget to calm some nerves and set out his plans for covering various possible Brexit outcomes. It’s doubtful he’ll go out on a limb with anything. So really, trading this is about deciphering whether the budget is investor friendly or not, and whether any targets he sets out are achieveable or pie in the sky. The latter is something that will be decided by economists and market watchers over the rest of the week.

The OBR forecasts will get a lot of attention too but we pretty much already know that the big components like productivity forecasts are likely to be lowered. Again, it will be down to the economists to say whether Hammond plans conform to the OBR estimates or whether THE OBR deem his budget unachieveable.

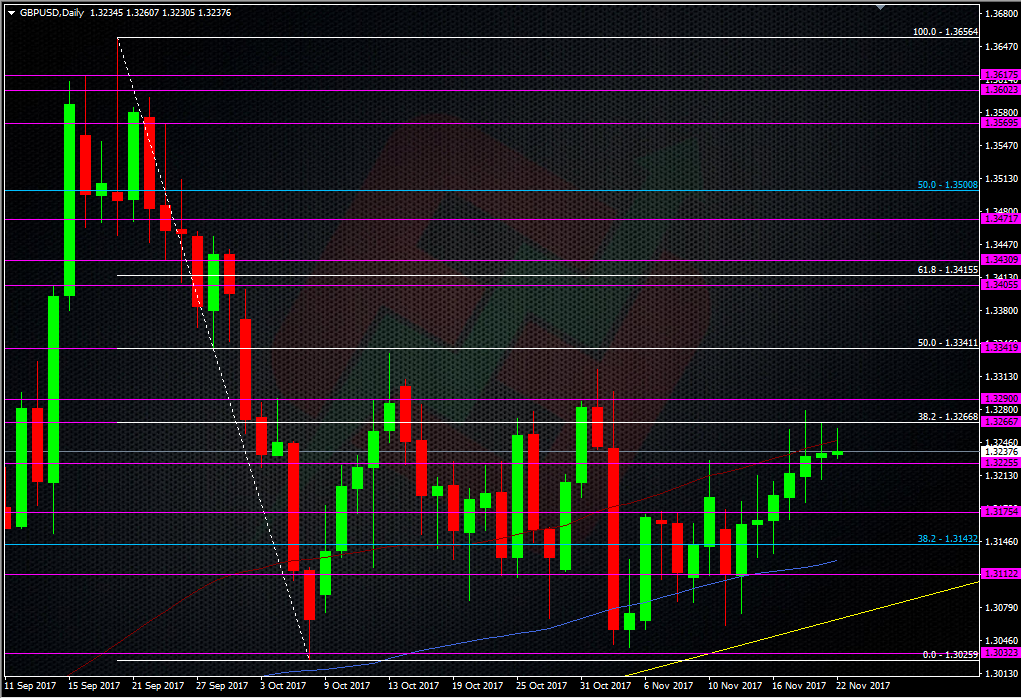

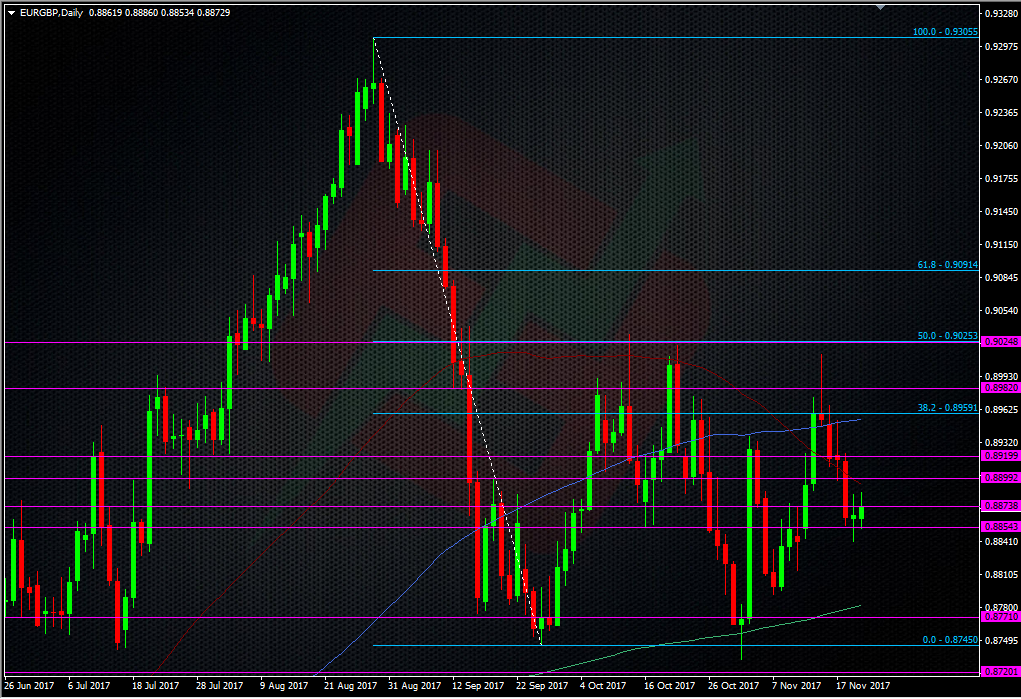

Whichever way we look at it, there is price risk so we should look at the charts and see what levels might be, or come into, play.

In GBPUSD, the 1.3300-1.3340 looks good as resistance on mildly positive news, while anything stronger will bring 1.3400/20 into play and would be somewhere to see any rally find a decent brick wall.

For the downside, 1.3220/30 is always a consideration but as we’re close to that level now, use it if we see a move up away from it, and then a return, or if we move way below it, and then also return. 1.3175/80 has offered support and resistance recently. 1.3150, 100dma at 1.3126 & 1.3100/15 are the next considerations.

For EURGBP on the upside, 0.8890/0.8900 (55 DMA at 0.8893), 0.8920/25, 0.8950/60 (100 dma 0.8953) are levels to watch.

Downside, 0.8850, 0.8840, 0.8820, 0.8800 and 0.8775/80 need monitoring.

The whole shebang starts at 12.30 GMT but if you want some early entertainment, click in to the Houses of Parliament for PM’s question time. The place will be packed to the rafters for the budget so PMQ’s is likely to be more fun than usual. That starts at 12.00 GMT and you can watch it here.

Take care of you’re trading this and I wish you many pips.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Excellent! Maybe better to wait and see… but I like to short eurgbp right now.

Great stuff mate.

nice piece mate 🙂 lets hope for some good uk news here to lift spirits and also to scalp some pips!!