Yesterday I posted about AUDNZD. The fibs went on to give their own masterclass for intraday traders .

We have to cater to a wide range of traders here on the flow from newbies to the advanced among you. The technicals shown here are basic and relatively simple. I cant stress enough how much I like the simple approach in trading, especially intraday. I have always held the view that if we can’t master the basics then it is always going to be a difficult journey skipping and jumping ahead to more complex technical indicators, many of which (on back testing) give us no more than a 50% evens chance of success .I will post more about some of techniques I use in the New Year and also some of the better systems we can apply in our trading to give ourselves an edge .

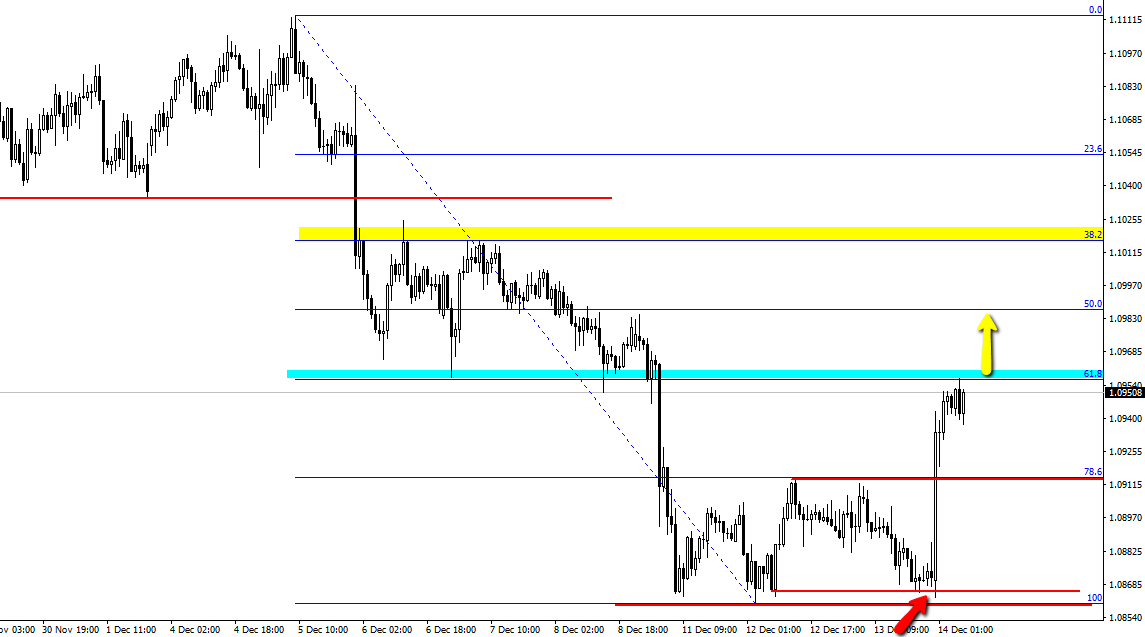

On to the fibs and the AUDNZD. The December highs to lows highlighted some superb intraday levels over the last few days. Again , we all have our different ways of trading the markets. I’ve never made a secret of the fact that I enjoy scalping/poaching for pips during the trading day. Keeps me awake and focused and often a simple scalp from levels can turn into so much more and evolve into a position that I want to hang on to and build upon with a longer term view .

I have posted the chart from yesterdays post below. It was a simple trade to try and capture a bounce over data . With a tight stop loss in the event that the data/numbers went against me . In this case it was the Australian jobs data. Most important to stress here that I wasn’t trying to second guess the data. This trade was taken because of the good risk reward offered to me at the time.. Price had bounced from the lower levels on several occasions prior to the release and I simply (there’s that word again) opened a long position with a stop just under the price lows .

The numbers/data turned out favourable and price bounced, giving me an opportunity to take part of my position off at the 61.8% fib level. – What happened next was also interesting . Price began to move in a very precise manner between the fibs, eventually finding a top at the (green line) 50%.. This had me actively trading the moves throughout the day and turning my long position to short using the fib levels combined with tell-tale weakening candle structures along the way.

Not a bad days work from trading a single cross instrument………..Yet most importantly — Simple .

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019

Thank you Horatio. This piece is good 4 me 🙂

You’re most welcome icy 🙂

There will be more to come on the basic trading principles and some trading systems that actually work .