A disappointing New Zealand GDT auction -3.9% combined with a larger reported trade deficit – NZ$ -1.19bn vs -550m expected could weigh on Kiwi .

I had the NZDJPY on the way up and I’m now turning my attention to the short side. My previous post can be read here and the one that got me buying here .

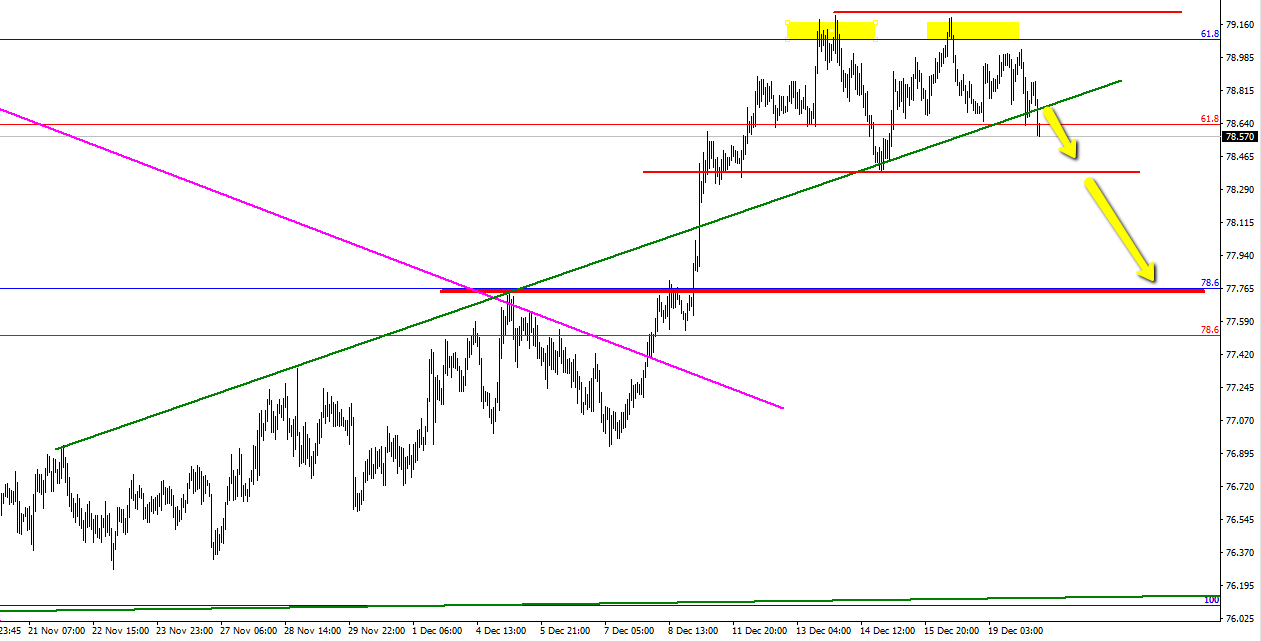

Plenty to like about this chart. Price stalled at the 61.8% of the July high-November lows (yellow areas) on two occasions and is now the area to beat for us to see further upside gains . We have broken under the trendline (green) over the past few hours and a short term double top is signaled if we breach the approaching red line around the 78.40 level below. I’m not the biggest fan of shorter term double tops or bottoms it must be said, but they all count and are worth considering if you take more of a macro view and are searching for shorter term positioning.

The current weakness in Yen across the board has to be taken into account here – Yet as as always…….Every cross pair has its own story to tell .

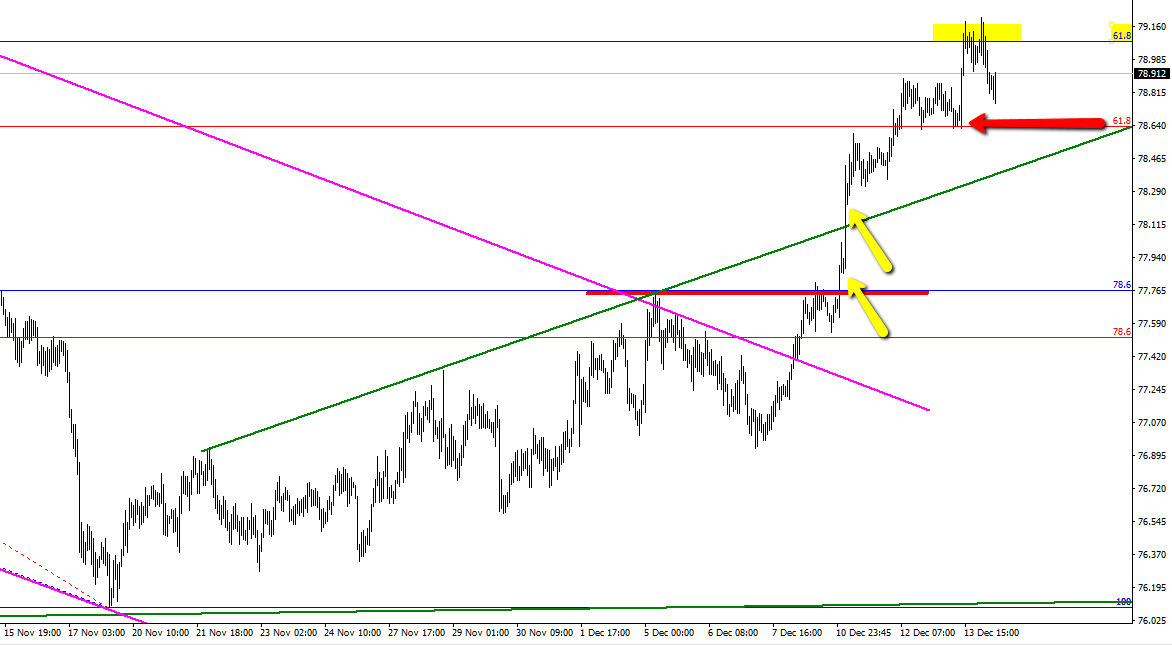

Here’s the re-post of the chart below that signaled caution on my long trade

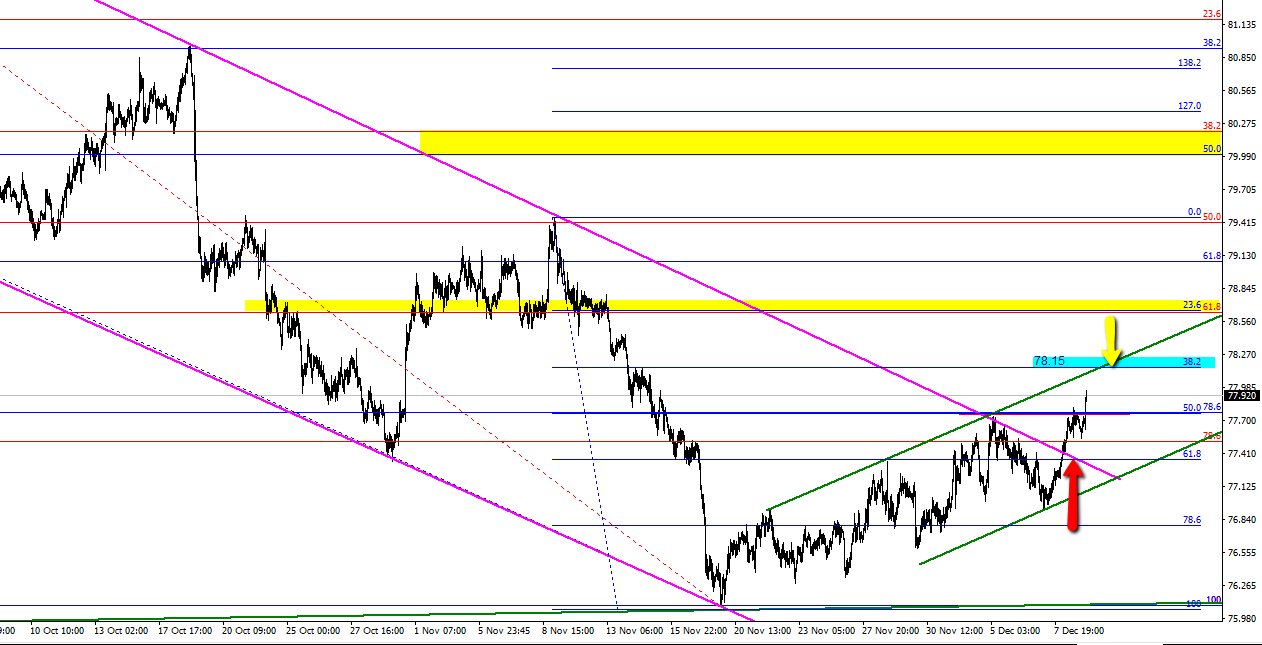

The chart below shows my original entry . The links to my trade ‘journey’ are provided above .

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019

The flip side to this trade was EURNZD and the suggestion to go long early in the week has really paid dividends.

Keep up the great work Horie. Nice calls

I actually made a screw up of my original entry on EURNZD .

It paid off this week 🙂