It’s nearly time for the US jobs report but maybe we should think about parking this in a siding and trading the Canadian report instead

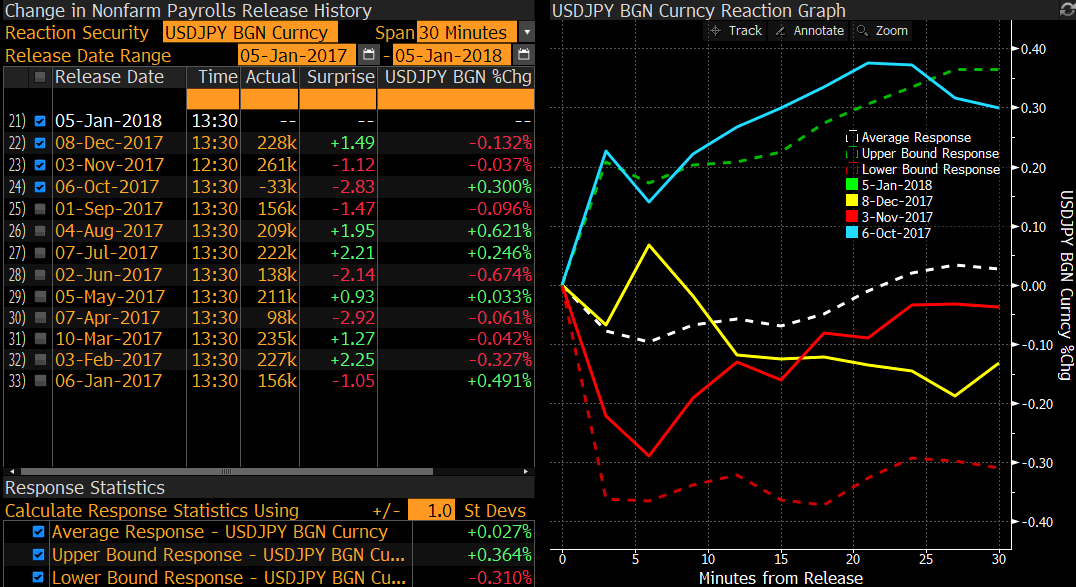

Despite the US jobs report being the biggest data point of the month, trading wise it’s lost its shine. Barring the -33k we saw in Oct, reaction to the NFP has been very subdued.

Unless there’s some big shocks from the headline number or wages, we’ve been pushed to get a decent move in FX markets.

Today’s numbers aren’t expecting any shocks;

- NFP 190k exp (both BBG & Rtrs).

- BBG hi/lo 240k/132k. Avg 192.11k

- Rtrs hi/lo 245k/160k. Avg 191k

- Average earnings exp 0.3% vs 0.2% prior m/m

- 2.5% vs 2.5% prior y/y

- Unemployment rate 4.1% exp vs 4.1% prior

Yesterday’s ADP report has probably set the market up to look for a stronger headline but we can never rely on that 100%, so the market may get disappointed if it doesn’t see a number over 200k, and it might not take kindly to anything under 190k. Unless wages really take off, anything on or just above expectations is going to mean more subdued moves but maybe with a slight positve edge. Lower than expected wages is potentially the bigger market mover as Fed hike watchers will be eyeing that closely. As usual, use a 2pp variation to guage any possible reaction (2pp or more, bigger market reaction, under 2pp, lesser reaction).

The best of the best NFP pickers (top 5 pickers) have read their tea leaves as usual.

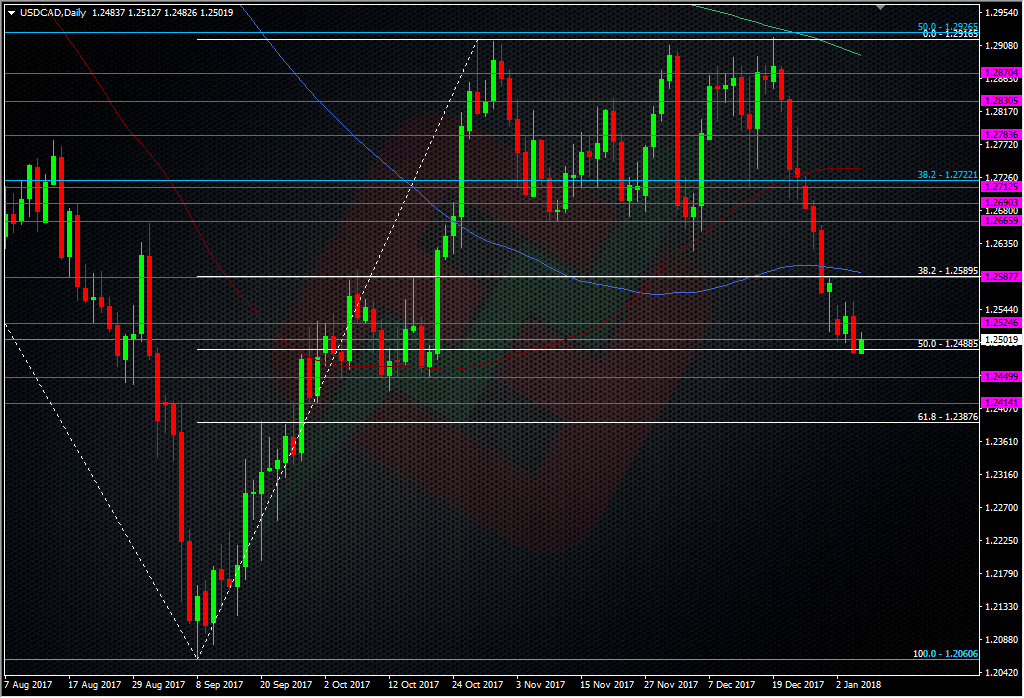

Given that trading opportunities have been sparse for NFP, maybe we should ditch it in favour of trading the Canadian jobs report, considering how volatile CAD is over big data?

As the loonie likes to go potty over data, this might be the best pair to look for opportunities. Here’s the numbers expected;

- Employment change 1k exp vs 79.5k prior

- Unemployment rate 6.0% exp vs 5.9% prior

- Full-time change 29.6k prior

- Part-time change 49.9k prior

There’s one key point to consider in this report to properly judge the strength of the jobs market. The full-time/part-time numbers have mainly been a revolving door i.e one month up, one month down, and that’s driven me bonkers for years, there’s been no real trend whatsoever. A good strong jobs market will have a healthy trend into full-time jobs, largely at the expense of part-time posts. At the moment, full-time change has been on a 3 month winning streak so a continuation of that will show a strengthening labour force. The only possible fly in the ointment for this month is that there could be a lot of seasonal skewing as obviously December can be a big month for increases in part-time work to cover the holiday period. But anyway, we can expect more bang for our buck looking at trading opportunities here. Given the way the market is leaning, I think the trade to look for is to fade a decent sell off in the CAD on a bad number. Late last year I would have traded the opposite but I think the picture has changed since, as I explained earlier this week.

As we know this pair can shift on the data, a pop of 100-200 pips is not out of the question. 1.2585/90 offers an area of resistance but we’re pretty close to that right now (1.2506 at time of writing. A better level might be to look for a run to 1.2650/70, that being the old support area in the latter part of 2017.

With the extra tailwind of higher oil and commod prices generally, fading a CAD sell off has that extra force in our favour.

As, I’m looking to trade the after-moves of these reports, not taking a punt on their outcomes beforehand. Trade safe and allow yourself time to assess what’s going on before jumping in.

Good luck and don’t forget to enter our NFP competition.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Great advice mate. 1.2440 and 1.2390 I think is the areas to watch on the downside. I cant log into ryver on my mobile so it’s disqus for me today.