I’ve been watching this cross with an eye to layering in some short positions.

GBPNZD can be a monster to trade at times. The small intraday swings can be sharply ‘ V ‘ shaped and often leave you questioning your judgement. That’s why it is very important to try and time the best entry possible with wider stops than you would apply to the major pairs. I am a little concerned that Kiwi could be running out of juice after a good run, yet we could say the same about the GBP – So trading this purely on technicals for now.

If I’m hoping for a larger target, then I layer in several positions over time with my larger core position at the beginning of my trade sequence.

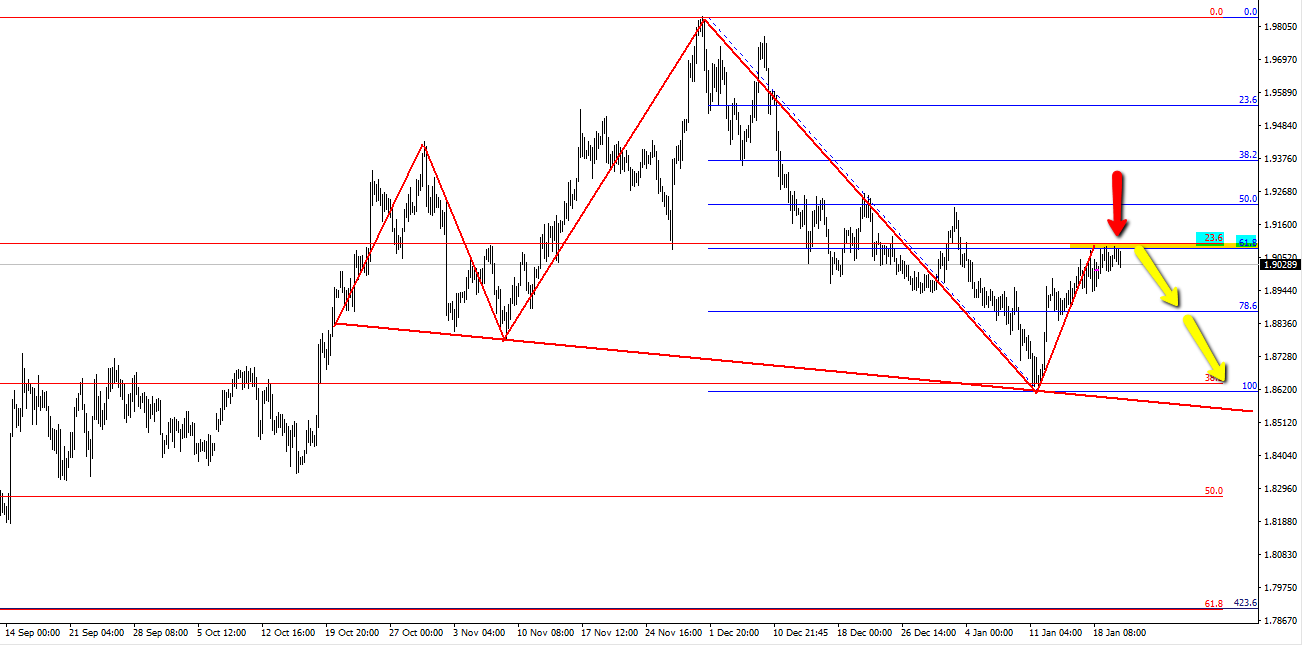

I have opened my first short position at the fib combo highlighted on the chart, so this will be a low risk trade from here with price starting to move very slightly in my favor today. — The fibs are the large swing from the November 2016 low to this years January high at 23.6% of the move – and the 61.8% of the smaller November 2017 to the same high marker of the January 2018 latest highs…………..I have my stops situated above my 1.9070 entry below 1.9100 .

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019

could be a bit keen 1.90032 could provide some strong support and a bounce back to the upside

You could be right John . All depends whether we can pull out of the ranges we’re in ….. It’s all a bit boring at the mo, but this cross can really motor when conditions suit,

Having a punt with tight stops and fair entries is the best we can hope for, especially in these turgid markets.

seems the 1.90 support was strong support and price certainly did bounce to the upside although today the short looks viable with a potential swing down to the 1.9125 level and maybe even below the 1.90 support.

You picked that turn handsomely John, Well done !

I had some slack to play with from my short entry and ended up taking some pips before it hit my b/e. We’re hanging around the 38.2% of the swing low from November at present.

So I will have a look next week…I’m biased higher from here as the recent GBP strength is impressive….and the Kiwi could be due for some corrective moves .

The GBP strength is certainly impressive probably as much to do with the weak US dollar as pound strength just wondering if the dollar may rally a wee bit and the pound could pullback a tad at least although the NZD does look like its going lower against the US dollar so I would think a break above 1.9450 and I am long but as you say its probably one for next week.

Are you in the USA? If yes what broker are you using???

Hi Horatio, long NZD via EUR could also be promising. What is your opinion? Thank you for your time!

Hi Vitor

I am holding short from last week …. so yes I agree the trade has promise

Here’s the link to my post.

https://www.forexflow.live/2018/01/15/technical-analysis/decision-time-for-the-eurnzd-pattern/

Timely! Thank you for the link.