Forgive the Dickens reference ( another one follows ) yet there is no best or worst of times to write this.

I have a big problem with moving averages. 200MA -100MA on any timeframe are bunk to me. I say this with small pressure of my tongue in cheek as it’s not easy being a forex rebel.

My intention is not to become the most hated guy in Forex ( feel free to berate me in the comments below ). My purpose is merely to offer a civil forum and open debate on why lagging indicators such as moving averages are so respected as a tool in todays markets.

Depending on which surveys you believe. 90 – 97% of us humble retail traders lose money. I was privy to a survey last year that stated 90% of retail traders use or deploy moving averages in their personal charting — So they obviously work huh ?.

Yes. They can act as a self fulfilling prophesy and you can see the occasional bounce from a MA, especially if you have a cluster from different timeframes. My simple rule for the 200 – 100 MA’s is – Above both = bullish – Below both = bearish. That is where my love affair with MA’s begins and ends ( or would begin IF I could be bothered to give them chart room ).

If you use MA’s within a system then you have my utmost respect. I can never be that robotic, but I know traders personally that use these systems and seem to work the markets well. I can also see the irony in my argument against Moving Averages in that a high percentage of traders use charts. …..So anyone of us who uses a chart as a trade guide is a percentile loser from the inception of our trades .

There’s no going back for me now . I hope to remain a successful trader . One of the few ( if surveys are to be believed ) that does not rely on imaginary friends. The most important aspect of charting is to realize who our trading friends really are. If you are new to trading…….. Question everything and learn which friends to trust .

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019

please dont feel annoyed when i ask you question…..

? I could never be annoyed Qian Feng . My only frustration could ever be not knowing the answers my friend .

Interesting post which naturally raises the question what indicators you use;) ?

Dang it Michael you mind reader and lay prophet ?

I was thinking of making that a post for next week .

Let me wallow in being the most hated guy in forex for this week and then I can give everyone a real reason to dislike me :))

? ahh ok, so I will eagerly anticipate next week…don’t forget, in for a penny, in for a pound….

An interesting post. It’s quite funny really as I like moving averages but thinking back a while, I can’t remember the last time I traded one on its own.

I do like a confluence of MA’s, especially if there’s a few from multiple time frames.

Horses for courses really as I know H loves a head and shoulders but I think they’re witchcraft and users are worthy of pond dunking 😉

At the end of the day, the main exercise is using something to lean against and define your risk. I could get marker pen and draw a physical line over a chart on my screen and use it as a technical indicator and trade off it.

Good post anyways.

So far you have threatened me with tar and feathering and now pond dunking .

Maybe if I can get them over with on the same day ?

It could be rather risky in these parts as hunters could mistake me for a fat duck ?

Not hating you, aren’t we at Easter time? 🙂

For many time I was wondering why certain MA are more observed than others – existential question! The answer seems simple imho as you stated – “They can act as a self fulfilling prophesy”. So, if it works, existential reasons became secondary.

Good trades for the next week!

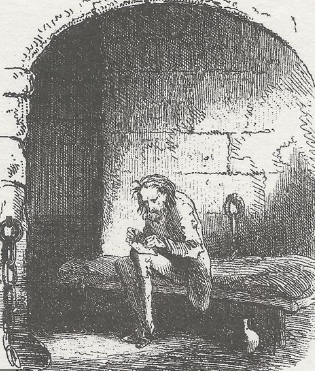

“It`s in vain Trot, to recall the past unless it works some influence upon the present” David Copperfield.

Did he say that before or after he made the Statue of Liberty disappear ? 🙂

All black-magic and withchcraft me duck 😉

Funny how circles are squared. In the year that Dickens, the creator of David Copperfield, died,, Bartholdi sketched the first Statue of Liberty design of a huge woman holding a torch. The statue was bult in 1883 and then in 1983, David Copperfield made the statue disappear.

Old Boz stepped out and Lenin stepped in. Just as well Lenin did step in, otherwise we would have no Stranglers 😉

Indeed a wonderful post! Indicators can at lest give traders a “false” comfort in a market which full of uncertainty, just like what pigeon did in Skinner’s pigeon experiment. I hoped someday I can trade on a naked chart, but hey, psychology also revealed that human tends to have a lot of other fallacies, like recency, priming…, so maybe MAs, Fibs… help to correct/fight bias brought by other fallacies. And after you can get rid of all those human fallacies, you would trade very successfully simply on a naked chart, or you don’t need to trade anymore?, cheers, wish you all a pleasant holiday if you celebrate it.