Friday 29.06.2018 FX closing rates

Winners: CAD, USD, EUR

Losers: all the others, well mainly ZAR,Yuan, JPY and Scandies have had to swallow some serious dust.

It’s been a yoyo for the EUR and GBP: they got beaten up first part of the week and then recovered hard today, EU summit immigration deals, month end demand for the one and better data, quarter end demand especially in the case of the GBP.

Poloz tried to break the 1.3380 resistance in USDCAD but confused te market so much by sounding half hearted bullish afterwards. Cad made the most serious comeback in 48 hours in a good while on data, oil and the BOC outlook putting July rate hike expectations from 70% to 50%, ending the week above 80… We close in a support zone but of those rate hike expectations continue to grind higher, 1.3050 may be achievable in the near future. That’s what some of the traders in our room, who swam through the rough waters being short USDCAD, are expecting. Nice job!

The USD gained against most of the other currencies as month, quarter and half year end fixings saw some demand, not so catastrophic vibes around trade wars turned risk around in the second part and… USD is a high yielder

Risk got a lift overnight with the EU summiteers reaching an agreement on immigration, putting JPY under pressure after having tried to gain for most of the week.

It’s tough to keep JPY longs for to long as well in current rate environment. The rest was month end JPY selling.But we failed at 111 tonight, which may give the shorts some hope again.I’m neutral to a buyer on 110.00/30 dips for USDJPY.

Yuan is guided lower to make the USD more expensive but some worry about deeper problems looking at the liquidity injections deemed needed. Are we talking about Chinese QE here?

Scandies were a case of people being a bit to long. A bit strange NOK didn’t benefit from oil strength in the end. SEK saw some softer data and EURSEK went back through the mid 10.30S congestion zone. I’m not involved but level above 10.50 towards 10.55 may attract my attention.

It’s bit a yoyo week for me same as the markets. Had some good and less good positions. USDMXN short is running smoothly. The rest has been a case of jobbing and finally not making to much headway.I have a small cable short running that I traded around after the fix, short at a decent average as a result. I’ll be watching the 1.3220/25 to gauge the viability of this one. Next week hopefully there will be a theme surfacing to put on some more medium term stuff, now we’re starting Q3.

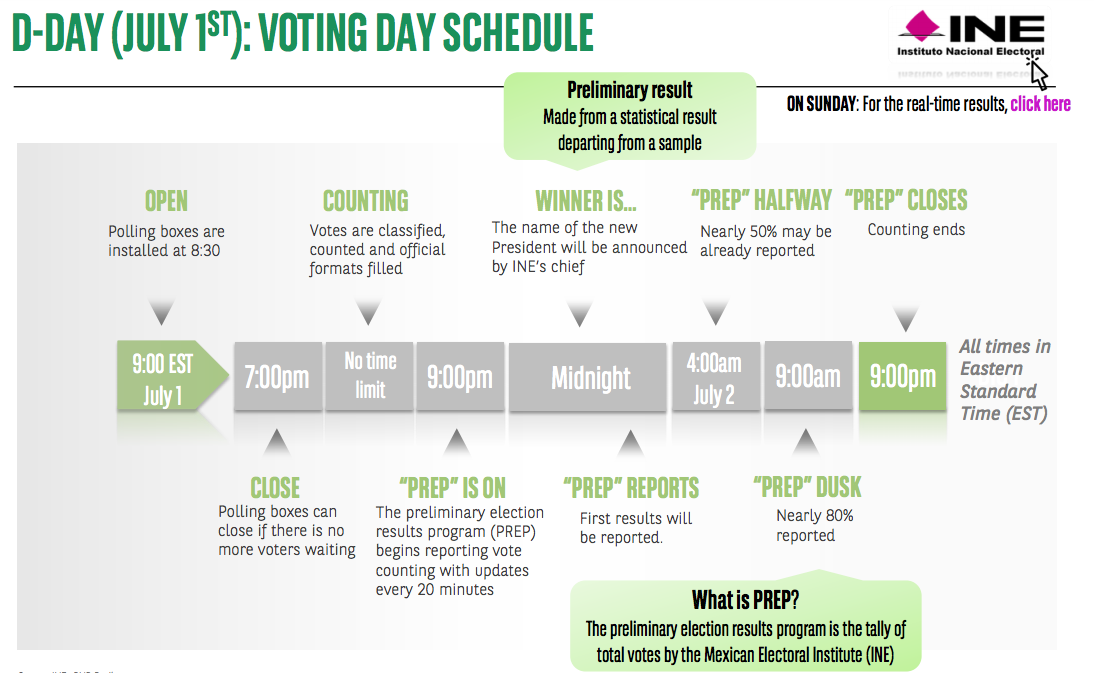

We will be looking out for the Mexican elections to guide USDMXN this Sunday. Watch both end of the 19.50-20.24/27 zone for clues.

Here’s the expected timeline for the results:

Rest me to wish you a great weekend. Thank you once again for your company, hopefully we could assist you in getting a grip of what’s sailing in these markets.

Good luck to the ones making it into the knockout phase of the WC. For others do relaxing, refreshing things, chill…

See you on Sunday night

- #Canada #Employment report preview. - November 5, 2021

- Rotation, ROTATION! - November 24, 2020

- $CNH living on hopium? Big week for the Yuan this. - January 13, 2020