A few observations on Kiwi as we enter the new trading week..

I noticed when going through charts earlier today that NZD was running in parallel flags on many of the crosses -. Every cross should be judged on its own merits, so just an observation at this time.

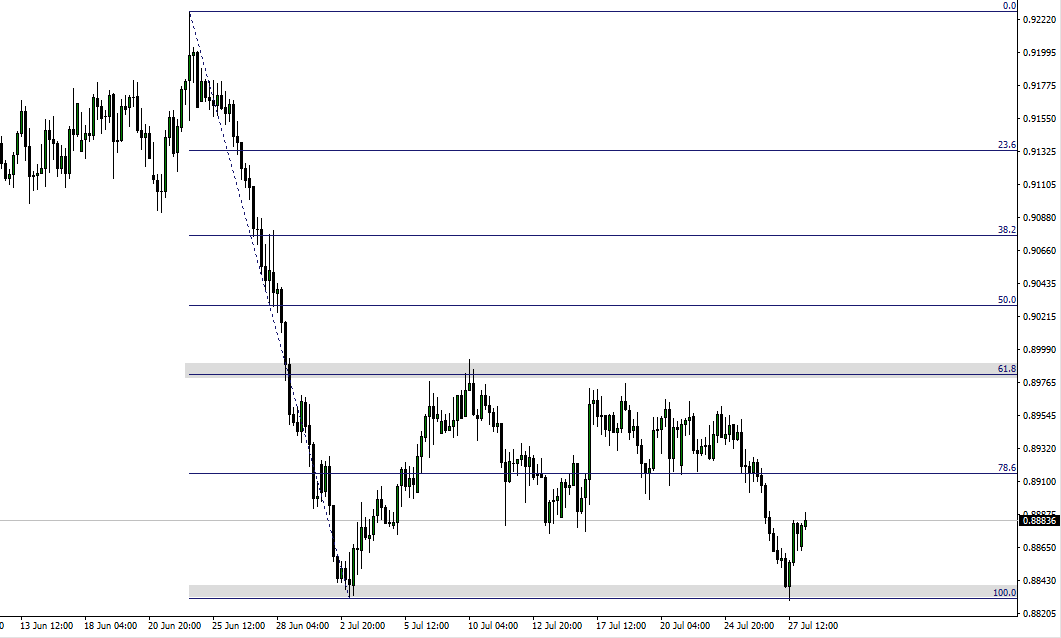

The simple chart of the NZDUSD below is not giving us much of a clue . A move towards / break above the 0.6860 area is needed to liven things up.

NZDUSD – H4

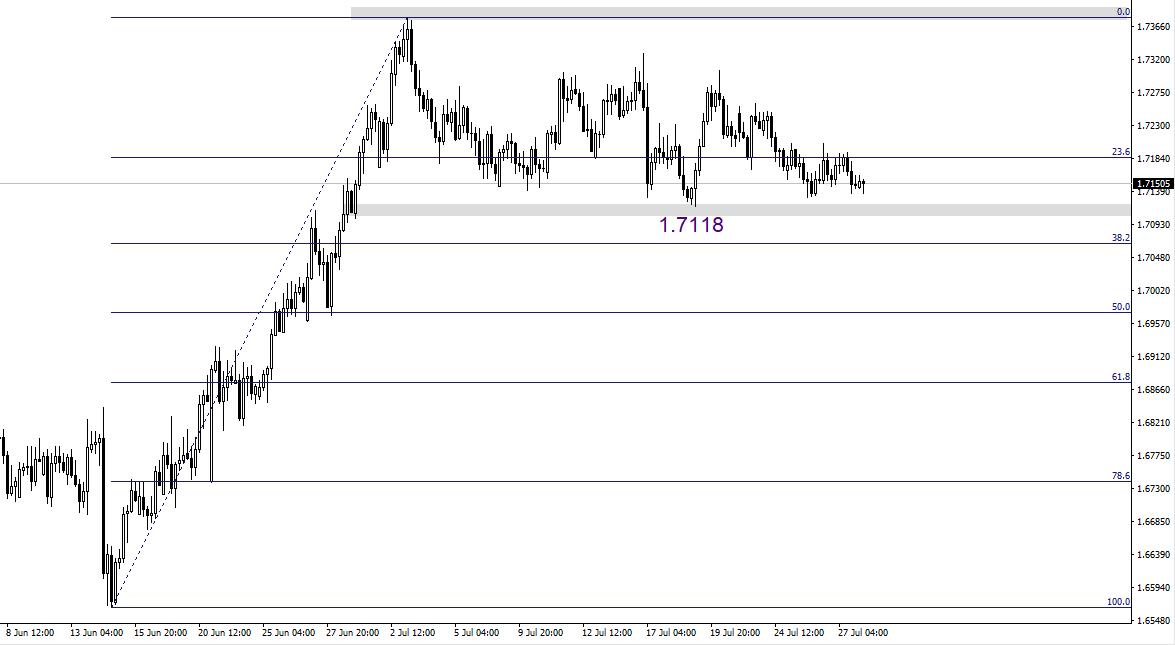

NZDCAD – Bounced nicely from the July lows on Friday . A break of this low should see an acceleration of any move down and a new lower range. Price is penned in by the 61.8 fib to the topside, presenting decent risk reward for both buyers and sellers.

NZDCAD – H4

Similar sideways action on the EURNZD with a sideways flag forming. This time at the top of a range..

EURNZD H4

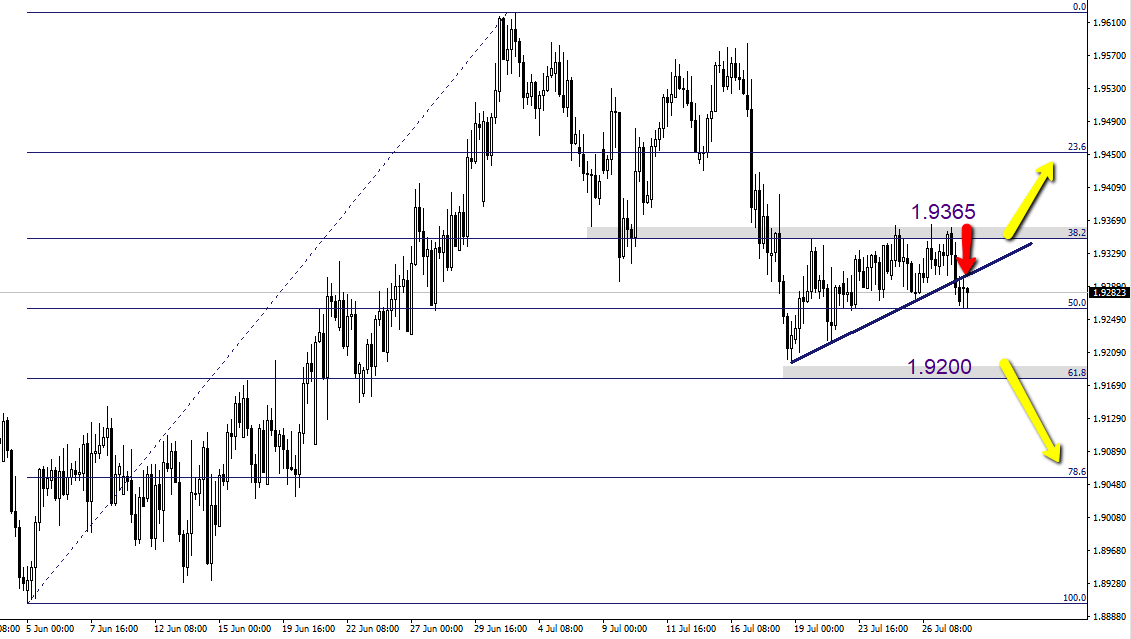

GBPNZD – could be the pick of the bunch this week. I’m using the 61.8 – 31.2 fibs ( June lows – July high ) as my gauge to take a more substantial view on this one. Big day for GBP on Thursday and I’m looking for a tradable resolution. — I scalped short from the blue trendline today in Asia ( red arrow ) and took quick pips at the 50% fib…….. This could prove to be a rinse and repeat trade today .

GBPNZD – H4

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019

how about NJ? master

No big view on that at this time Q.

We could see some JPY weakness going into BOJ and it’s very dependent on the way the market see’s it after that — I’m being extra careful with anything Yen up until then .

how about NJ? master