EURAUD has been an incredible one-way ride since the beginning of August.

I had the feeling it was topping out ( short term ) yesterday and placed a sell suggestion in the ForexFlow trading room at 1.6304

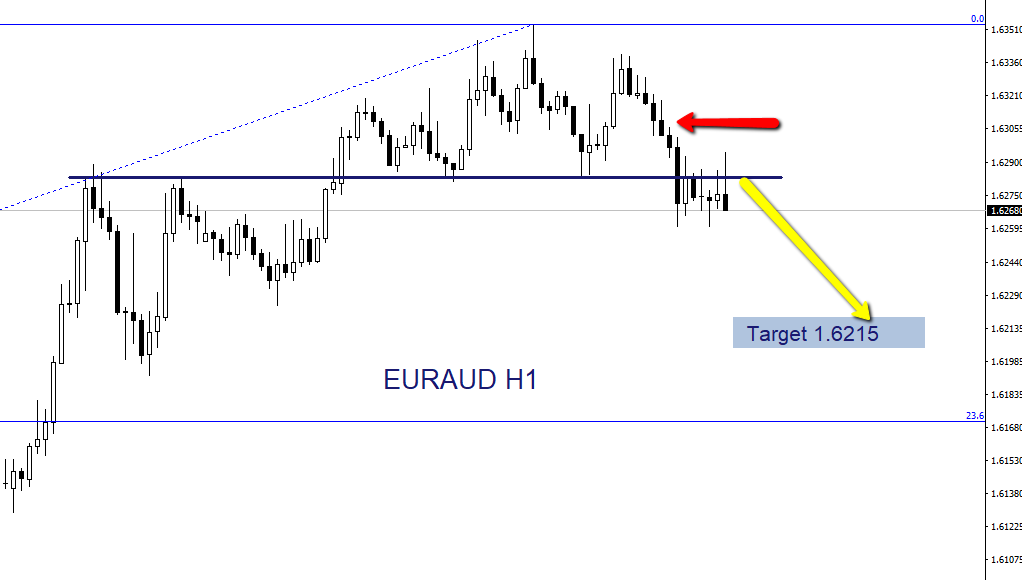

It looked to be struggling on the H4, so I waited for the hourly chart to confirm the weakness and opened a position with my stop at the Asia highs. There was a visible head and shoulder pattern forming. Price was dropping from the right shoulder offering a good risk reward trade. — Once the neckline broke I set my target.

EURAUD – H1

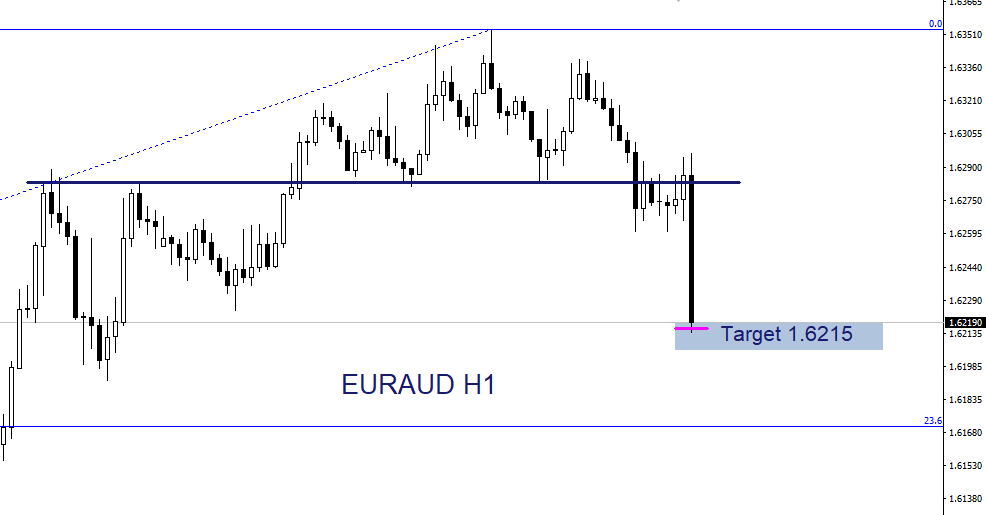

The break lower was a swift move……..

EURAUD – H1 target

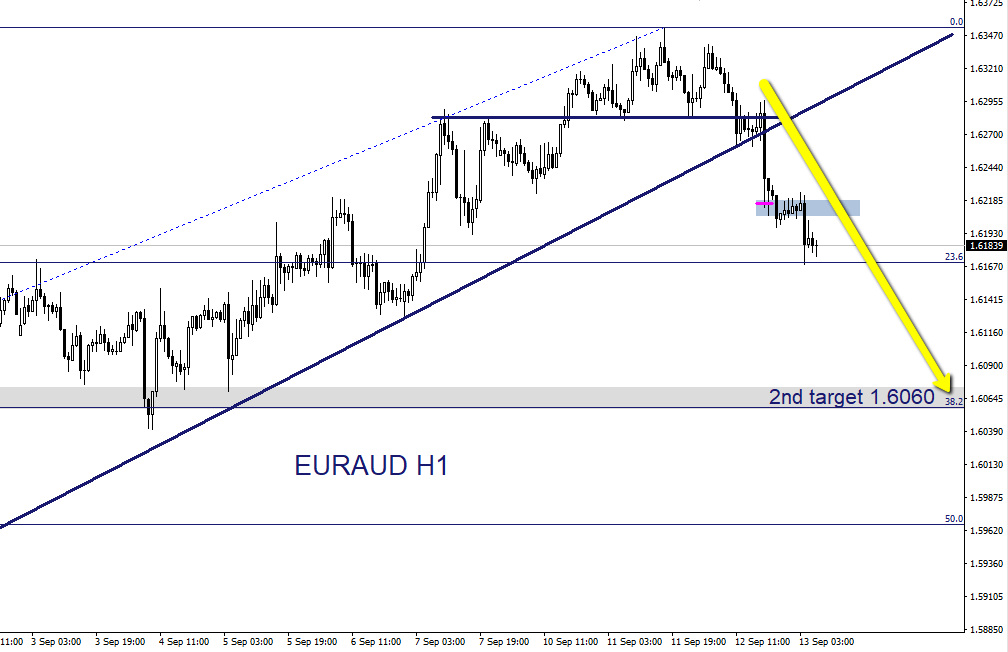

I’ve decided to hold on to the trade, as we’ve seen further weakness after the target was hit. AUD has put in a strong bounce from the lows against USD along with a good showing on the various crosses. The silver tongued Sig. Draghi and the ECB will have a big say in whether this trade progresses later today. If the Dragster runs to form and gets his legendary wiggle on we have a fair chance of reaching the 2nd target ( 38.2% of the Aug low-Sep high ) in the near future. ……. Stops will be placed above price to preserve profits in case of surprises.

EURAUD-H1 live

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019

The pair has topping out with big technical reason: Fibb 50 retracement of entire decade range: 2008-2018…. – up to the pip.

That’s very interesting Prutar.

I tend not to look back that far . Even more impressive as those long term levels are not normally that accurate and price often bounces around in a range either side before making up its mind.

In this case also Fibb 38,2 acted on similar way – on June 1st 2017 and Oct 11….and subsequently worked as support level – real technical beauty.