Trade update on my USDCAD shorts ahead of the BOC

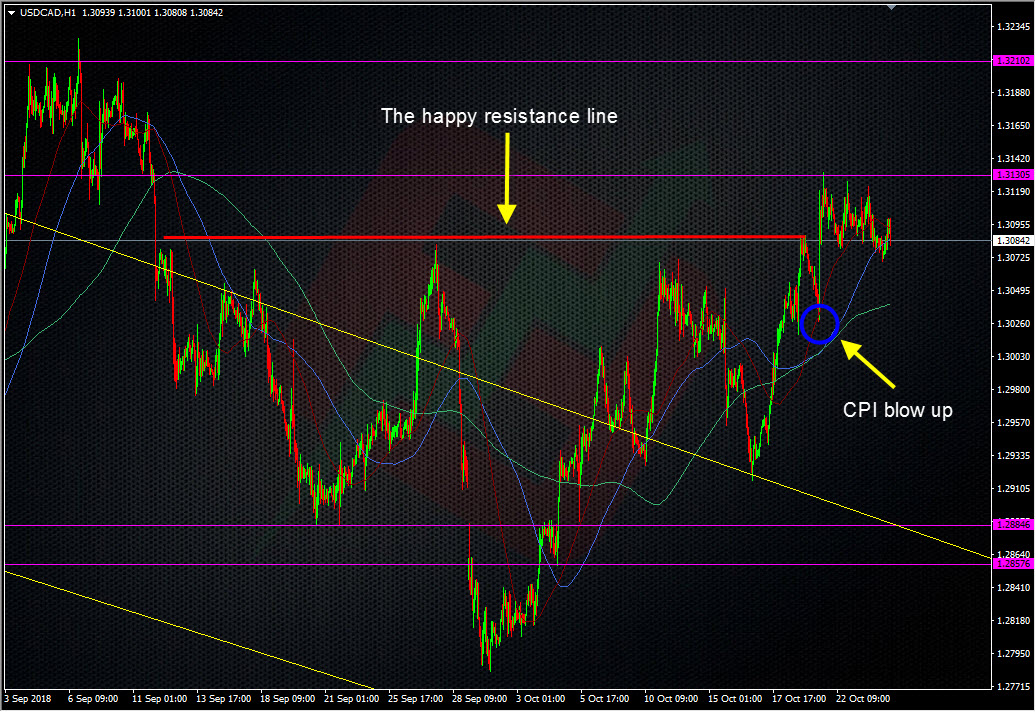

Last week I started shorting USDCAD. My plan was going swimmingly until the Canadian CPI data. Scaling into USDCAD shorts in anticipation of today’s meeting was looking good on Friday as it traded around 1.3030 after hitting its head on the main resistance area.

Then came the CPI report and it was a shocker for my trade. My plan was to build up some good margin as the market turned its focus on to the BOC. That move down to 1.3030 from 85 was exactly that as it came as hike odds went from 78% to the 90%’s in a day, and ahead of the CPI data. I had also planned to add to shorts up at 1.31 so the data gave me that opportunity. The issue is that the dynamics have changed since the CPI report. Despite the hike odds still being high (currently 95.6%), USDCAD has parked itself up between 1.3080-1.3100, meaning I’ve not got any of the margin I was looking for. It also means that I will need more than the expected rate hike for CAD to rise, and that’s not a position I’m comfortable with as I’m “hoping” for a big unknown to go my way. I don’t trade hope so as far as I’m concerned, I rule it out of my thinking.

As we know from “expected” outcomes, the price tends not to move much so a hike alone isn’t likely to bring anything more than a kneejerk, and that might not be anything special.

So what am I going to do now?

The trade hasn’t conformed to my plan so now I’m purely focused on minimising any losses. For that I need to know the risks from here.

- CAD doesn’t bounce much on a hike announcement

- There’s nothing additionally hawkish about the future from the BOC

- The outlier is that they don’t hike

Now, this trade may still come good but I never plan for what could go right, I only focus on what could go wrong, because that’s what stops a potentially bad trade from turning into a horrendously bad trade.

From here, I’ll be looking to put in a 50-75 pip stop seconds into the announcement (I’ll judge the price action before deciding). That will give me a defined loss for any bad news. If it’s something like a no hike, this pair could fly 100-200 pips, so I’ll be protected from that. My average is short around 1.3060 so I’m not too far out the money at the current price. I’ll be looking to nail any knee jerk drop lower to either bail out the whole trade, or to take some off and bring the stop right down to BE or better.

Whatever happens I’ll need to be on my toes for trading this one.

As with all trade plans and ideas, sometime’s they work out and sometime’s they go wonky. What must not change is how you protect and control the trade to minimise any losses.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

I love the last sentence, “As with all trade plans and ideas, sometime’s they work out and sometime’s they go wonky. What must not change is how you protect and control the trade to minimise any losses.”