Occasionally living in the Asia timezone and trading the session can be lucrative. It tends be a little slow at times without news or data to spark life into the period, however I enjoy the lower risks and thinner liquidity and get lots of scalping done.

The USD began to find a little love early in the session and I jumped on-board. It wasn’t a ‘close my eyes and dive in’ type of jump. I had my strategy together with my stop loss boundaries worked out well in advance .

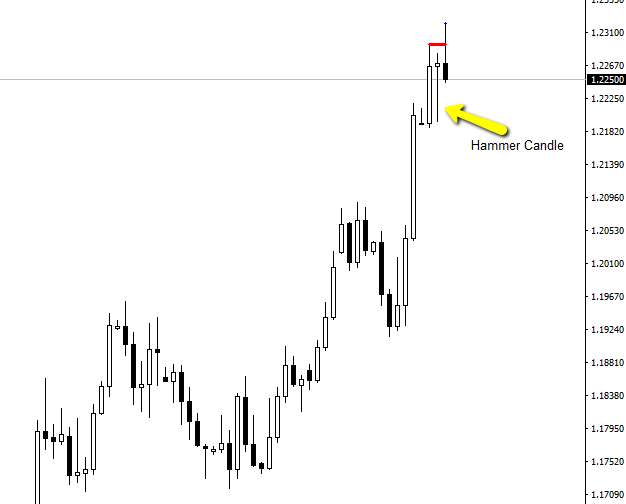

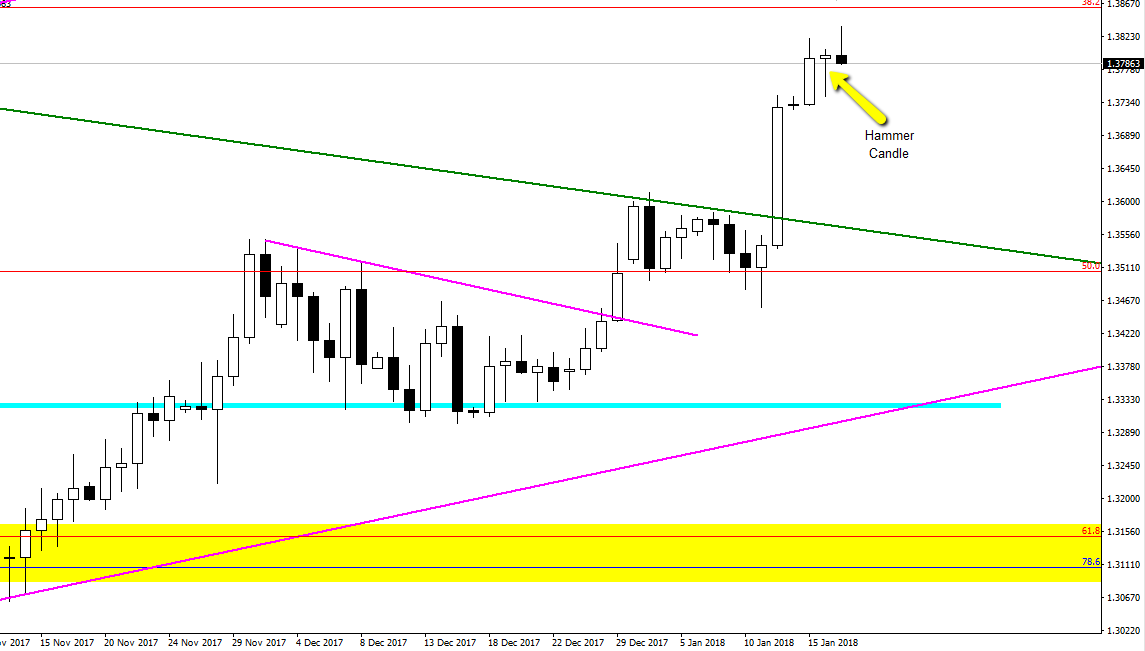

Yesterday, a few of the major USD pairs made Hammer Candles on the charts after strong uptrends. This is never enough for me to throw caution to the wind and open short positions at the Asia open…………but it did give me a heads up that the trends could be softening, and also gave me clear levels to trade from, along with areas to focus my stop loss .

The Daily charts of the EURUSD and GBPUSD below both show Hammer Candles that can often be seen around the top / bottom of trends and can often signal periods of consolidation, and on occasions the end of a run .

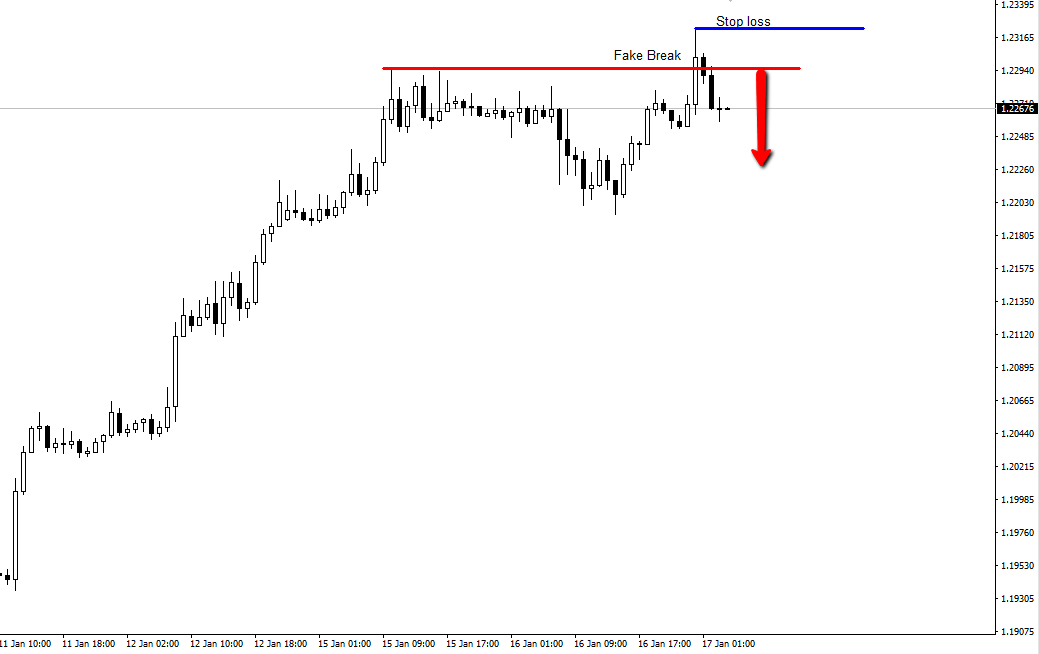

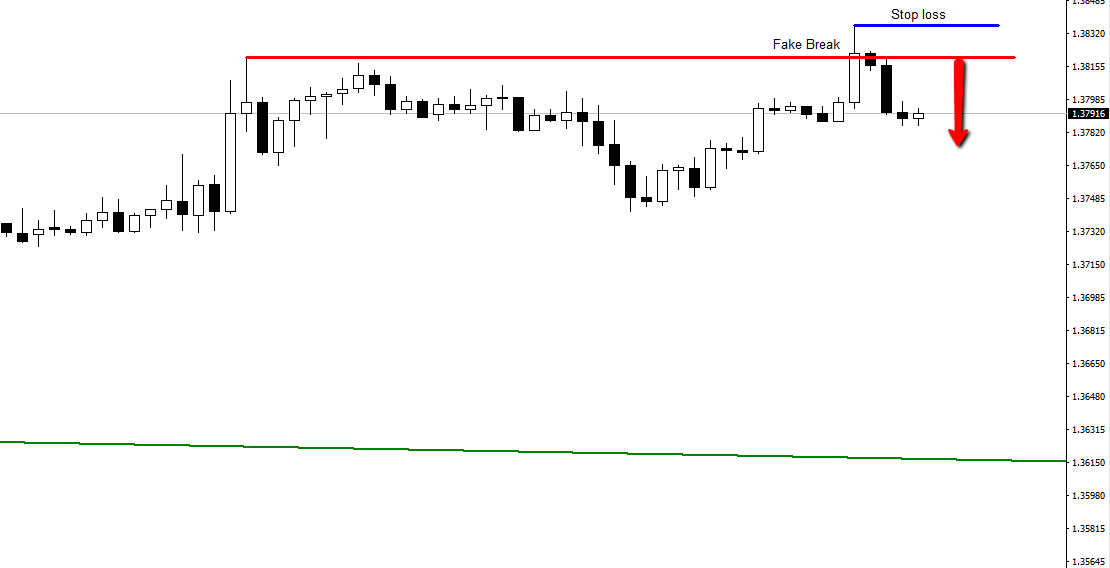

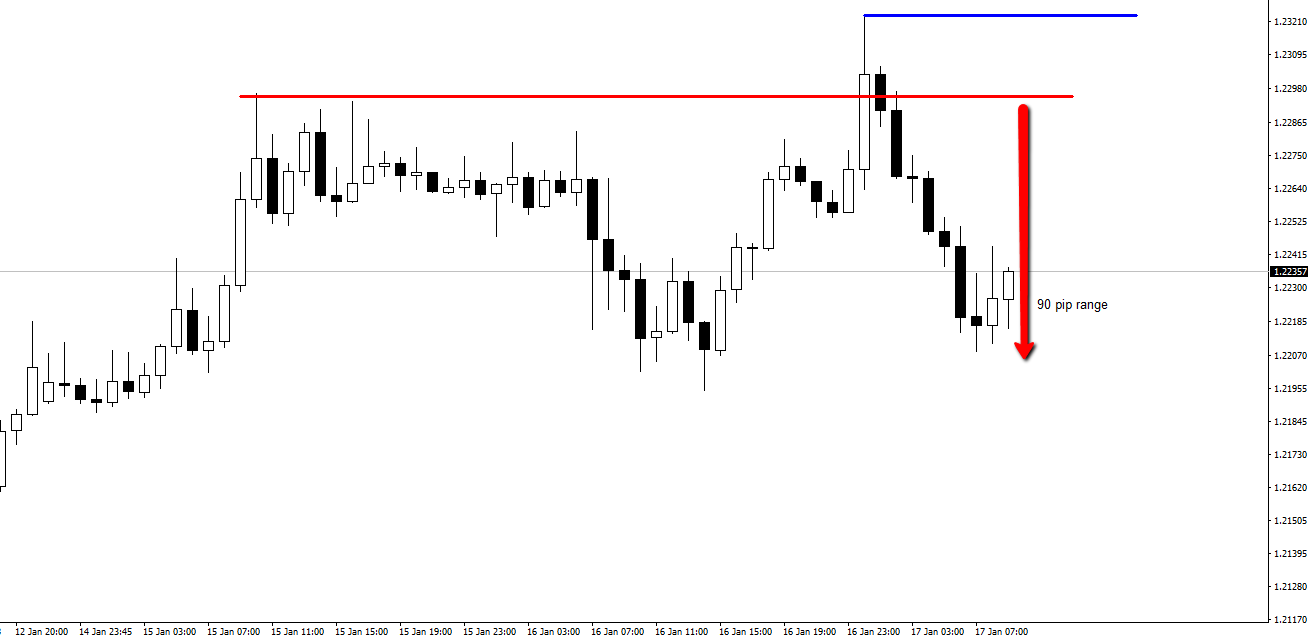

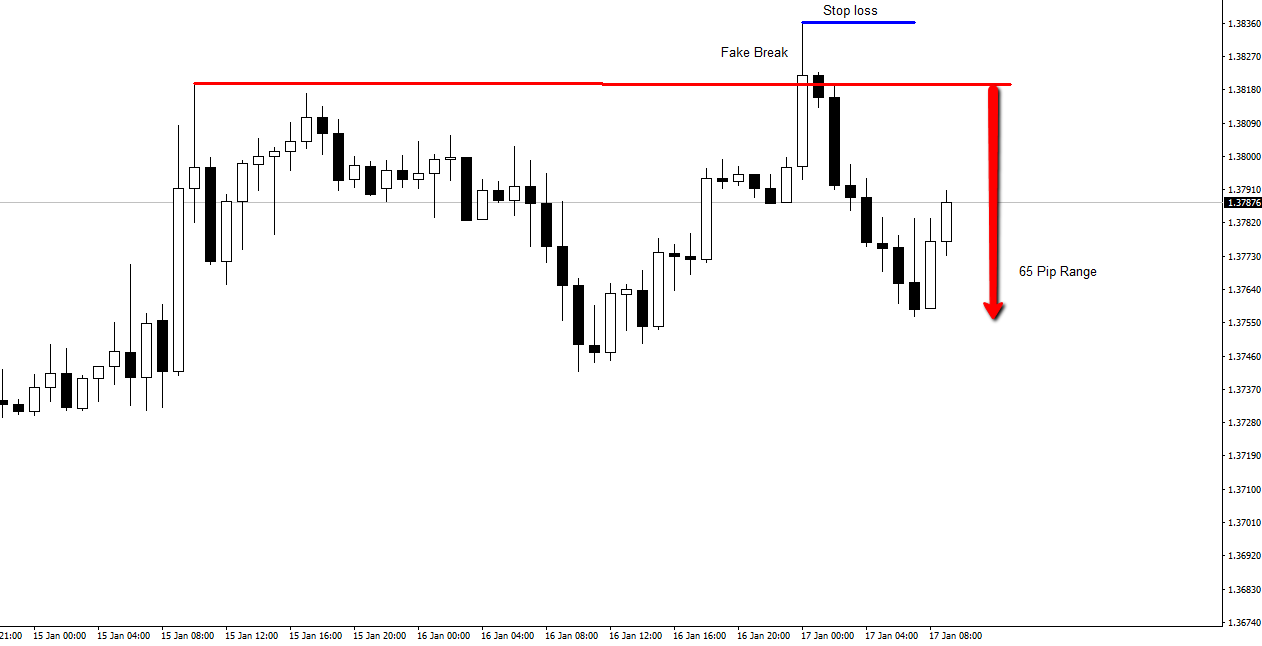

Now on to the Hourly charts and what happened today in Asia ,,,,,,,,,,,,,,,,,,,Both charts witness a price breakout of the Weekly highs. — I sat on my hands as I watched this develop, mindful of the Hammer Candles on the D1’s the previous day and also aware that breakouts in the Asia timeframe can be fickle. – Price stalled above the breakout levels and reversed down as shown in the corresponding charts below .

These were both low risk trades with a high reward ratio, as stops could be placed at the highs of the failed break or even tighter at the actual breakout levels …….The resulting price moves are shown on the live charts below — If the Daily Hammer Candles hold true, then fading any rise towards resistance / the Asia high is still a play .

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019

Succinctly done as usual H. Very well played.

Thank you kindly Sir .

I woke this morning void of ideas …..The price action combined with the Daily warning signs fell into my lap rather nicely and suddenly things began to make sense .

Nice trading Horie

great explanation too

Cheers Johnners …Happy trading day to you

really need to copy and save your post off-line

Mastering the trading! Thank you!

Hi Horatio,

Thank you for sharing your Piercing Line Method and False Breakout – both are simple and smart. Just curious to learn as to what GMT or EST time frame did you initiate your EURUSD abd GBPUSD false breakout trades? Thanks.

Hi John

I use three brokers and post charts from whichever one I am using on my main work screen. The charts above are set for the Asia session with a slightly different daily cut off. I trade this one early in the session as the sever is local to me and gives me instant fills in low liquidity ( very important when trading from south west China). I had the idea some time ago that it would give me the edge in scalping for smaller gains in the session, but it really doesn’t make much difference as I soon realised it was the guy pressing the buy/sell buttons that is always the weakest link 🙂

I’m mindful of this when I post charts from this particular feed and check that any posts based on candles show more or less the same . The daily will show an extra small candle Sunday / Monday. The hourly’s the same, give or take a tick here and there. That’s very normal and down to individual broker feeds.