We should see USD buying this month as equities and bonds got sold off

Typically for currency neutral investors ,they need to rebalance at least parts of the currency flows induced by investments in bonds and equities at the end of each month, more so end of quarter or fiscal yearend.

As the US markets are by far the biggest on this little globe, the performance of these markets will create the more important fluctuations, in USD holdings. Therefor month end rebalancing acts will be felt more in USD pairs than any other currency. Although cross currencies see their own interests such as i.e. EURGBP or EURJPY, they’re more difficult to gauge as the amounts involved are of a comparably lesser importance and overshadowed by US as the biggest investment vehicle (for now ). Hence we’ve seen decent to good USD selling over the past months end fixings as US bonds were outperforming and US equities roaring.

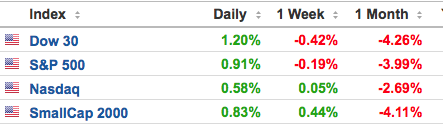

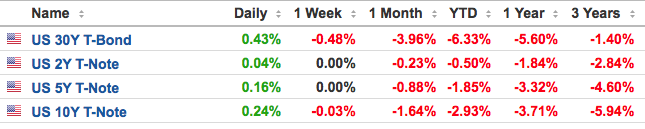

This month paints a totally different picture with US bonds taking a dive, yields shooting and equities bearing the brunt. So the models are calling for USD buying this end of month.

Compared to former years where typically we saw a concentration of these flows on the last 2 sessions of the month creating pretty violent swings in the space of the hour(s) ahead of the most widely used WMR fixing at 4pm London time, nowadays due to regulators’ involvement , transparency requirements and a much deeper direct access by investors, asset managers to the market, these flows tend to spread out more randomly over the last couple of sessions, but we will still the effect in some form. As I said before, quarter and year end flows are more important as not all intervenants hedge on a monthly basis but looking at the violence of this month’s fluctuations, we may see some interesting flows and moves. Typically they will take place in the main pairs EURUSD, USDJPY, CABLE, AUDUSD, USDCAD and some in NZD and SCANDIES.

As a trader we can use these flows in a few different ways, any of these I have or have seen used in the past.

- One aggressive way, we can surf the tide, go with them as we see them develop in the last hour or few hours ahead of the fixing and then cover the position in the fixing time which is 5 minutes around 4:00 pm London time.This is a risky strategy as we don’t know what exactly will happen, not for the faint of heart nor highly recommendable but it can give some fast pips if spotted right and entered/exited with the right timing.

- Two, we can wait and see what direction the fixings take us and monitor if the flows are with or against the trend.This is a more sensible approach which can give good value entry points to counter trade or put one’s position back in the way of the underlying trend or provide excellent take profit opportunities as it accelerates the trend. It’s more recommendable to use this strategy if one’s feeling to try and capture month end flow moves.

- Three: do nothing. Well it may in a lot of circumstances be the best way: evaluate, watch the moves and the speed of them and reassess once the fixing is over as to how it affected the picture.

I’ve personally used all three, mostly the second option as doing nothing is not really in the nature of a trader, but three is not bad either….

In the knowledge that these one time flows can on some occasions be large and distord a trend and therefor mess up the charts, take that into account. In some of the less liquid pairs we’ve seen wild swings in the past.Lastly we’re only the 22nd Feb, these models can change if the bond and/or equity markets evolve between now and next week

In no way though is this little piece is an invitation to start to whack it around on the fixings, just a heads up of what’s possibly happening next week on the last 2 days of the month and how the market participants may behave.

For reference , here are the Stock and bond moves so far in Feb

- #Canada #Employment report preview. - November 5, 2021

- Rotation, ROTATION! - November 24, 2020

- $CNH living on hopium? Big week for the Yuan this. - January 13, 2020

Great post K.

Thanks K, great insights as always

Awesome post Mr K

Nice report!

Great post indeed! Comeon stock and bond bears, don’t go back to hibernate just yet, good time to learn how you affect the flows. Thanks K.

Thanks, helpful advice!