It’s always difficult and challenging to try and make sense of charts from a longer term perspective

I noticed late yesterday that GBPJPY was on the way to making an outside day ( bearish engulfing Candle ) on the daily chart. I was hesitant to open a short trade and leave it overnight, especially with USDJPY nearing the bottom of its range.

I mentioned yesterday that I have changed my view on EURGBP from a seller to a buyer even though I’m still of the mindset that GBP should be supported due to the Brexit talks seemingly making progress, albeit baby steps forward……So here lies my dilemma ——-.If I’m not particularly bearish on something from a fundamental perspective, do I allow the warning signs that I see in the technicals take precedence over the way I am viewing the market ?……….. Is my attitude towards GBP wrong ?.

Being more of a shorter term ( scalp ) trader I often go against my ‘ bigger view ‘ during the day if I see a quick opportunity, I never have a problem doing so unless I am taking on too much risk and the rewards seem meager.

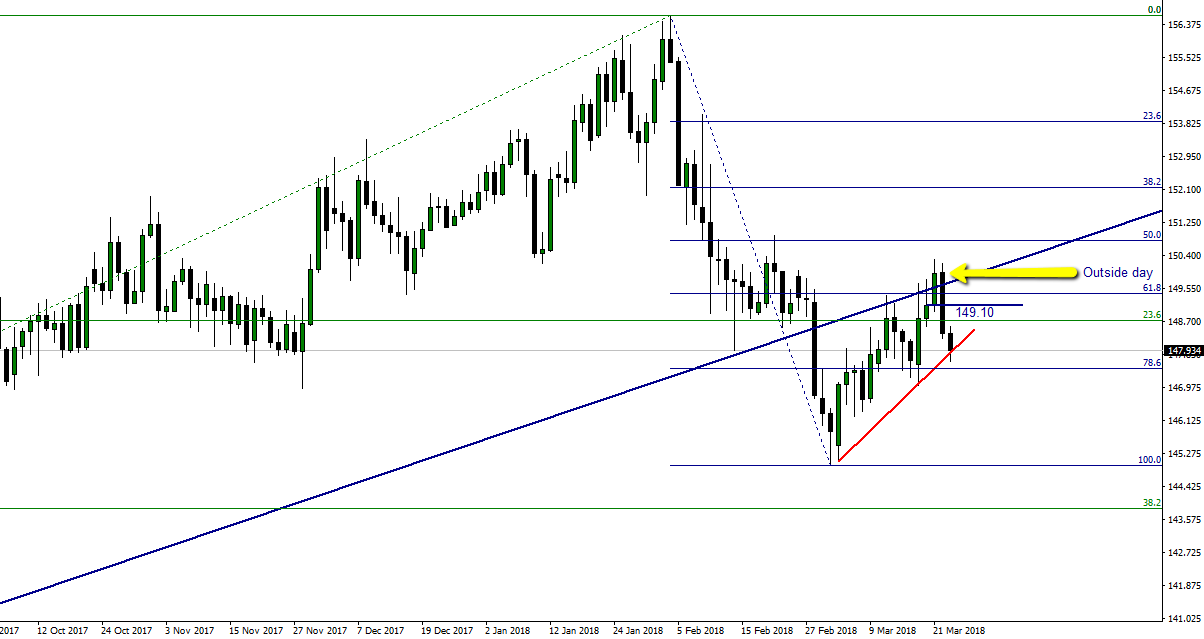

GBPJPY was the first chart I looked at this morning and noticed that it had continued to weaken a little overnight . I opened a short trade at 148.34. I’m bearish up towards 149.10, placing my stop at break even and will re-assess my new found short bias regularly over the coming days and curse those damn charts for working their voodoo on me if I’m wrong 😉

Bearish Candle on the weekly shown in the chart below .

Daily chart below showing another Bear engulfing Candle (Outside day ).

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019

i’m shorting AJ…stop at 35

? It certainly looks like it is on the way to taking another leg down shorter term.

Could come under pressure if equities continue to struggle

as you are aware, I like the trade the GBP X’s, so your analysis of Guppy is timely. There is one major MA to break thru and then Guppy would be in free fall, ie H4 100 MA @ 147.775. I agree in a short from here.

Afternoon JB

We cant forget your imaginary friends ( MA’s ) ?