Japan Q2 2018 preliminary GDP preview

While US and Japan meet in Washington for their trade talks , we also have Prelim Q2 GDP hitting the wires today. After last Q’s slump into negative territory at -0.2%,putting the yearly down to -0.6%, a rebound is expected with the new fiscal year,Abe/Kuroda’s push, better company and private earnings providing a boost. The QoQ number is exp to show 0.3% growth, the yearly 1.4%. Capex and private consumption are indeed seen as the leaders for better data, respectively at 0.6% and 0.2%.

These data will be a market mover in my opinion as they will influence the Japanese yields, which are barring the trade frictions, the pole of interest to the market and as they are dragging JPY and world yields with it.

After BOJ’s latest relaxation of the yield curve control for JGB yields to move inside a -0.2% to +0.2% range , the market has already began to test the topside a couple of times. BOJ showed their nose indeed on the 0.15% approach.

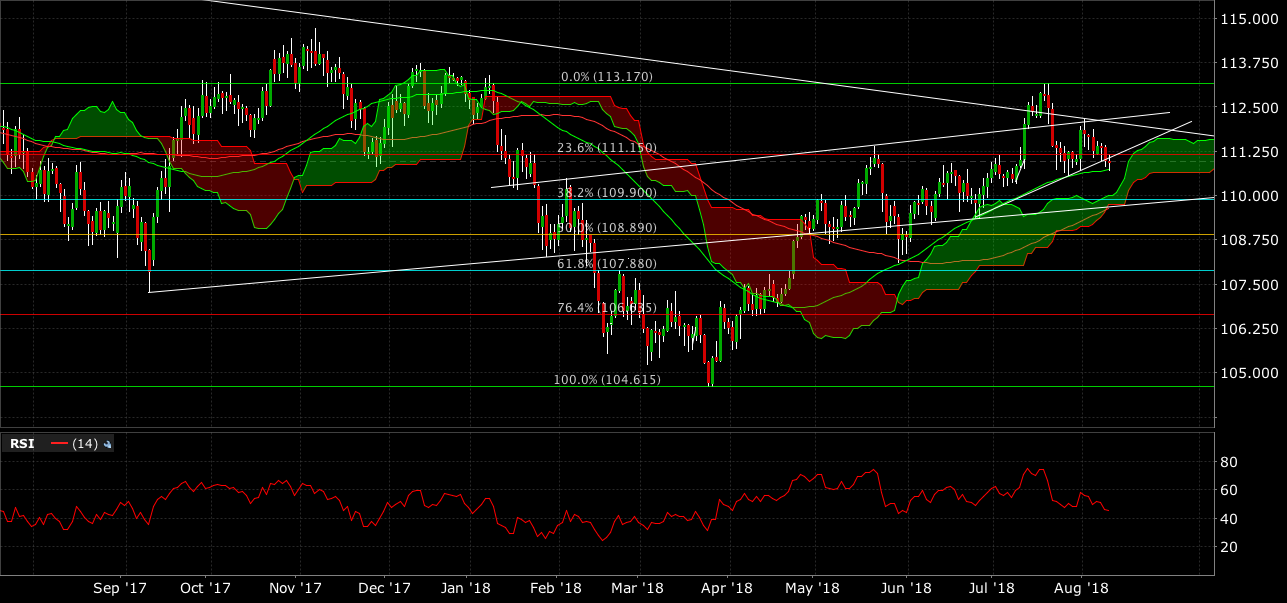

If the GDP data would confirm or overshoot, a test of 0.2% yield will be in the making in my opinion, putting upward pressure on the JPY. In this case the 110.50 stop losses Ryan referred to already a couple of times should be easy bait for the sharks and USDJPY should move down to 110 or even below.

Inversely a negative number would leave JPY vulnerable to some corrections after the past sessions’ up march, mostly based on risk off and each of the other currencies in the JPY pairs having its own trade, political or data problems. That would probably put most JPY pairs into a range with a 0.5 to 1% rebound not to be excluded in USDJPY( back the 111.50/60 or even 112), EURJPY or commod vs JPY.

Super H had a very nice update on his short USDJPY position with nice clean charts. Adding to his greatness, I’d like to draw your attention to the daily Ichimoku cloud, the top lying at 110.00 today and being a thin one(bottom at 109.70) could also be a decent accelerator if break should occur.

I’m also short USDJPY again from earlier today above 111.

Readers will know I’ve been running shorts EURJPY, GBPJPY and also a few CADJPY of late. I’ve taken profit on the GBPJPY and a minor one on CADJPY, leaving me short USDJPY and EURJPY going into the data tonight and room to manoeuvre.

Add to that any possible headlines out of the US-JAPAN trade talks …We could be in for a few wilder moves looking at the Summer liquidity we’re in and the hour of publication.

Stay safe and happy hunting for those who will be present at the time.

- #Canada #Employment report preview. - November 5, 2021

- Rotation, ROTATION! - November 24, 2020

- $CNH living on hopium? Big week for the Yuan this. - January 13, 2020

Thanks for the analysis K. very helpful

Great work as always Kmeister.