A trading preview ahead of another central bank ‘Super Thursday’

If market expectations are to be believed, this Thursday the Bank of England will hike its interest rate to 0.50% (probably) from 0.25%. Traders are around 90% certain that this will happen. Surely it’s a done deal…isn’t it?

What has the MPC been telling us?

There’s an old saying that you can’t fight a central bank, so what the MPC members have been saying is important. Here’s a summary of recent BOE members comments;

- Mark Carney – “Rate rise likely to be appropriate in the coming months“

- Andy Haldane turning hawkish as far back as June when he said that a “partial withdrawal of accommodation from the Aug 2016 cut would be prudent relatively soon“

- Ian McCafferty warned that he sees a slowing economy, and the bank fighting between a slowdown and rising inflation. He did offer us a hawkish slice when he said, “Balancing inflation and capacity will push interest rates up sooner rather than later“.

- Sir John Cunliffe said he’s not seeing signs of domestic inflation pressures, and then followed up by saying he didn’t want to anticipate a Nov hike.

- Ben Broadbent (July) “I’m not yet ready to raise rates”

- Gertjan Vlieghe turned hawkish is Sep when he said “The evolution of the data is increasingly suggesting that we are approaching the moment when bank rate may need to rise.”

- Michael Saunders (Aug) “But, our foot no longer needs to be quite so firmly on the accelerator in my view”. “A modest rise in rates would help ensure a sustainable return of inflation to target over time.”

At a Treasury Select Committee we had;

- David Ramsden “A Majority of MPC members saw a case for removing monetary stimulus in coming months. I wasn’t in this majority“

- Silvana Tenreyro “Most measures of domestically generated UK inflation have been below target-consistent levels”. “Some evidence that premature rate increase that turns out to be a mistake could need more cuts in future”. “If UK economy follows path broadly consistent with Aug central projections, policy could need to be tightened by a greater extent than markets expect”

A real mixed bag of opinions there but overall, there’s a case to say that there’s enough hawkishness there to swing a hike vote but it might be very very close if some of the members are just not quite there yet. What does stick out is that not one member has given a hint of a date of any hike. The most we have is “over the coming months”, so why has the market picked November? The reason is that we get the latest inflation report and forecasts, which by and large becomes a monetary policy press conference. That gives His Royal Carneyness a platform to jawbone any policy move and lay out the forward guidance.

The data also forms a massive part of the Bank’s decision thinking, so how has it been doing?

First, let’s look at how things stand since Brexit, and that August 2016 cut, courtesy of the excellent and free Dow Jones Brexit Dashboard.

- GDP current 0.4% (Q3). Pre-Brexit vote average 0.49%

- Unemployment rate current 4.3% (Aug). Pre-Brexit avg 5.09%

- CPI 2.8% (Sep). PBA 0.20%

- Services PMI 53.65 (Sep). PBA 54.39

- Manufacturing PMI 55.91 (Sep). PBA 51.77

- Retail sales y/y 1.2% (Sep). PBA 4.10%

- House prices y/y 5.0% (Aug). PBA 7.08%

inflation is the standout here but some attention needs to be put on the retails as a sign that inflation is squeezing pockets.

Let’s look at the data since the last meeting back in August, as members have been saying that if it conforms to projections, they’ll go for a hike;

- GDP Q4 2016 0.6% q/q, Q1 2017 0.3% Q2 0.3%, Q3 0.4%

- Y/y 1.6%, 1.8%, 1.5%, 1.5%

- Consumption Q4 0.4%, Q1 0.4%, Q2 0.2%

- CPI y/y Jul 2.6%. Aug 2.9%. Sep 2.8%

- Core CPI y/y Jul 2.4% Aug 2.7%. Sep 2.7%

- PPI input y/y Aug 8.4%. Sep 8.4%

- PPI output y/y Aug 3.4%. Sep 3.3%

- Services PMI Aug 53.2. Sep 53.6

- Manufacturing PMI Aug 56.7. Sep 55.9

- Composite PMI Aug 54.0. Sep 54.1

- Retail sales (ex-fuel) y/y Aug 2.6%. Sep 1.6%

- Sales deflator Aug 3.1%. Sep 3.3%

- Unemployment rate Jul 4.3%. Aug 4.3%

- Jobless claims change Aug -0.2k. Sep 1.7k

- Average weekly earnings Jul 2.2%. Aug 2.2%

- Earnings ex-bonus Jul 2.2%. Aug 2.1%

- Q2 unit labour costs y/y were revised up to 2.4% vs 1.6% originally, and 2.1% in Q1

- Q2 productivity -0.3% vs 0.1% prior y/y

On the whole, there’s not a lot of change there, but where there is change, it effects inflation. CPI was lower, output PPI was lower, Earnings ex-bonus was lower, retail sales deflator was higher. Possibly the most important number to look at is the change to the unit labour costs as that is a measure closely followed by the BOE. In fact Michael Saunders wrote in a speech back in January;

“Unit labour cost growth is perhaps still slightly below the pace consistent with the inflation target over time”

The ONS revision to 2.4% from 1.6%, and the jump from Q1 potentially gives the BOE some ammo to hike, as it keeps the figures above the inflation target.

The question is, has the data done enough to warrant a hike since August? On paper, taking in all the data, the answer is no, it’s been pretty flat. However, inflation is up above target and the one big piece of information that tips the balance is the Core CPI. Headline CPI can go where it wants and the BOE can do little about it. The core is a different story and when the MPC sat down in August, the core was at 2.4%. Now it’s at 2.7% and well above the Bank’s target, and that target is important as ex-MPC member Martin Weale made clear in 2014;

“The MPC’s goal is, however, first and foremost achieving the Government’s inflation target, which it aims to do over a two to three year horizon”

The BOE mandate says;

The Bank’s monetary policy objective is to deliver price stability – low inflation – and, subject to that, to support the Government’s economic objectives including those for growth and employment. Price stability is defined by the Government’s inflation target of 2%.

So really, this meeting all comes down to the MPC’s tolerance for this high inflation, something members have mentioned previously. Productivity could still do better, so there’s still plenty of slack in the economy. The BOE have been going on about that for nearly four years and the picture isn’t improving to any great degree, so they really can’t keep using that as an excuse not to hike because now inflation is taking over.

Once again I’ll use the usual central bank chestnut that the BOE is stuck between a rock and a hard place. On one hand we have an economy ticking along but looking fragile, and on the other we have domestic price pressures well above the bank’s target. We also still have the looming clouds of Brexit.

Whatever the BOE does will be a risk. If they don’t hike, then they have less ammo to fight any real slowdown in the economy and any Brexit driven downturn. If they do hike, they risk hurting the economy at the expense of fighting inflation, which is potentially hurting the economy. Who’d be a central banker eh?

What’s the conclusion, hike or no hike?

I think the market’s expectation of a hike this week is very high, perhaps too high, and while this might be the best PR opportunity for the BOE to hike, and give further verbal forward guidance because they have the presser (otherwise it’s March 2018 for the next one), it makes sense to do it now. That doesn’t mean they won’t hike and tip the nod to Dec.

I’m very much split on what they’ll do on Thursday. Part of me says that the data altogether isn’t strong enough for a hike but purely on inflation, it is. If they do hike, it will be a very dovish hike so the big risk is that we have a buy the rumour, sell the fact move in the pound, and we get a similar move like we’ve seen in EURUSD over/after the ECB. It won’t take long to switch back to the US side of things either.

If they don’t hike but give a nod to Dec then we could see a sharp knee-jerk sell off followed by a moderate bounce because the announcement will say “no hike” and any guidance for Dec may not be in the minutes but later in the presser.

If they don’t hike, and stick to a ‘hike in the coming months if the forecasts play out’ etc etc, the quid will get dumped bigly.

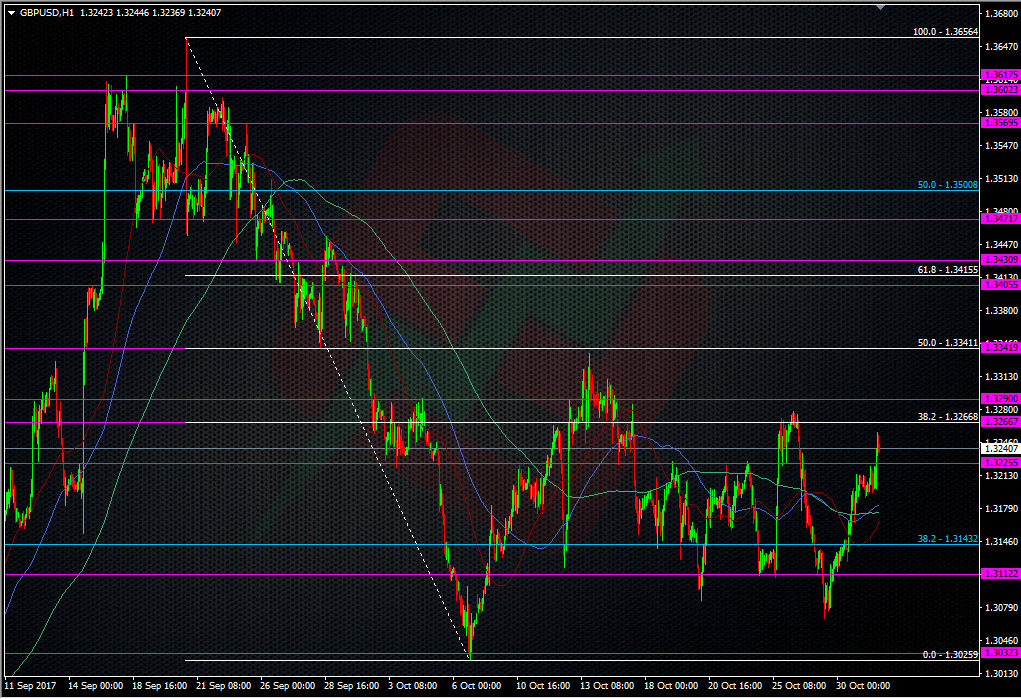

Trading wise, I can’t see any reasonable outcome where the pound doesn’t fall on this event, even if there is a knee-jerk higher. There’s just too much stacked up against seeing the quid rise. As of the time of this post, the pound has risen well off last weeks lows around 1.3065 to 1.3288, and that’s been in the face of some USD strength, particularly today (31/10). That suggests the market is getting all bull’d up on hike expectations, which currently stand at 87.2% on the Bloomberg metric. It had been as high as 90.6% last week.

I’m going to be looking to short GBPUSD into the BOE, either if we keep rising and hit some decent resistance levels, or right into and over the meeting. I’d prefer to nail a knee-jerk hike pop but I might take a smaller short into the meeting in case they don’t hike. I won’t be going in with big trades, just in case we do get some hawkish messages that follow any hike, and so I can potentially wear any rallies over the event. It will all depend on where we are come Thursday but basing it on current prices, I’d be happy to wear a move to 1.33 and possibly 1.34, shorting as we go.

It’s all set up to be yet another wild ride, and cable might give us a taste of her face ripping moves of old. If you’re going to be trading this, stay safe and good luck to you.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

share this view point and i’m sharing this!

http://justflipacoin.com/

🙂

I’m sitting on the fence so hard I’ve got splinters on my …….

1.338 is a good place to short GBPUSD and have an order pending there for sometime … if i get the price too close to this level i will change it…

GBPUSD ranges are extreme after brexit and any hike or not will give plenty of opportunities to “reenter”